While insurance companies have traditionally responded (paid claims) after incidents occur, factors such as diversifying policyholder needs and advances in information and communication technologies are calling for the reformation of that role. To prepare for that reform in the insurance industry, Hitachi has been using its NEXPERIENCE methodology (which provides a systematic method for creating new service businesses) to enable more effective collaborative creation activities with insurance companies. These efforts have involved studying how best to design new IoT-driven insurance services by looking at how insurance services can be reformed from reactive to proactive types. This work is one example of how NEXPERIENCE is being used within Hitachi. This article presents the results of this study and looks at the future outlook for insurance industry reform.

Department 2, Financial Information Systems Business Unit 4, Financial Information Systems Division, Financial Institutions Business Unit, Hitachi, Ltd. He is currently engaged in the development of new businesses in collaboration with an insurance company.

Department 2, Financial Information Systems Business Unit 4, Financial Information Systems Division, Financial Institutions Business Unit, Hitachi, Ltd. He is currently engaged in the development of new businesses in collaboration with an insurance company.

Service Design Research Department, Global Center for Social Innovation – Tokyo, Research & Development Group, Hitachi, Ltd. He is currently engaged in research into service business design methodology and application. Mr. Araki is a member of the Information Processing Society of Japan (IPSJ).

WITH Japan's changing demographics and customer needs steadily shrinking the domestic insurance market, insurance companies have been making various attempts to maintain persistent growth. Companies have tried various different approaches, but the following three common areas of focus have emerged.

Items (2) and (3) call for insurance companies to reform their insurance products from the conventional reactive types, which respond to accidents and other incidents after the fact, to proactive types, which provide services in advance.

Proactive insurance is designed to provide a safe and secure societal systems by avoiding or lowering risk through active services provided by the insurance company to the policyholder. Insurance companies are now looking to provide proactive insurance, and are considering various service possibilities as they work to concretize the concept.

Hitachi has developed a design thinking-based methodology for creating service businesses, called NEXPERIENCE, that it is now actively using to pursue customer collaborative creation opportunities. To prepare for insurance industry reforms, Hitachi used the same methodology to study how best to design proactive insurance products.

This article presents the future outlook for insurance market reforms using specific service business proposals created by Hitachi's study.

NEXPERIENCE is a methodology that draws on the deep knowledge of customers and partners to enable collaborative creation while visualizing service businesses from multiple perspectives. This methodology improves the chances of successfully creating promising service businesses by enabling intensive, high-quality discussion over a short time period(1).

Looking toward future collaborative creation business with insurance companies, Hitachi has used NEXPERIENCE to create an original service concept for proactive insurance. This concept was created in study workshops that brought together a wide range of knowledge from the entire company as ‘One Hitachi.' Workshop participants included domain experts with insurance business knowledge, service designers with service knowledge, and technologists with technical knowledge.

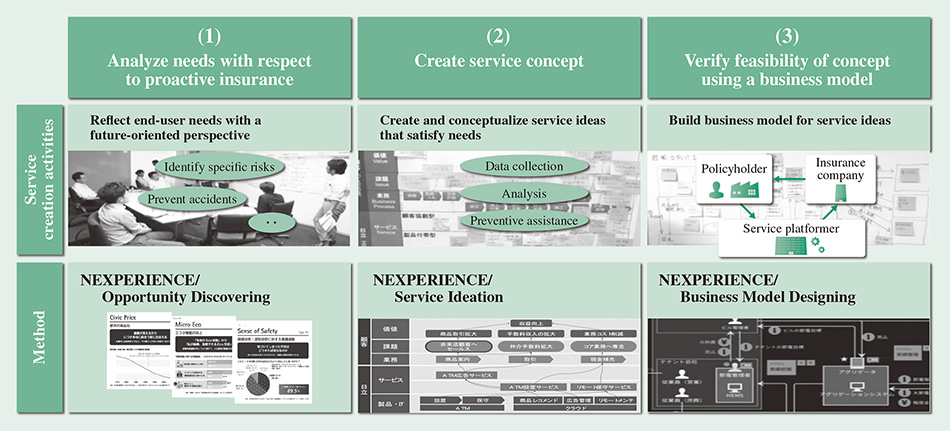

The specific service creation process is described below (see Fig. 1).

Fig. 1—Service Creation Process Using NEXPERIENCE.

The design ideas-based NEXPERIENCE methodology was applied to the insurance domain to formulate a service concept that accurately reflects end-user needs.

The design ideas-based NEXPERIENCE methodology was applied to the insurance domain to formulate a service concept that accurately reflects end-user needs.

The needs of policyholders (both individuals and businesses) who would benefit from proactive insurance were extracted by referring to the findings of “25 Future Signs for 2025.”(2)

25 Future Signs for 2025 is a booklet that describes coming changes that will affect Japan and the rest of the world. It was used as a method of extracting end-user problems and needs from a future perspective. This method was chosen because it was thought that a future-oriented approach that starts by accurately envisioning the future and then uses backcasting to design the business from that vision would be more effective for creating an innovative business than collecting data reflecting the present environment. Some examples of the end-user needs that were extracted are shown below.

The term specific risk is used here to represent the hazard rate and degree of impact of each item (person, thing, or work activity) covered by insurance.

Insurance service ideas that satisfy the extracted needs were created and then refined as a service concept. The technologies that will be needed to create actual services were studied in order to improve the feasibility of the service concept. Some examples of the service ideas that were created are shown below.

Implementing these ideas will require field data and knowledge in addition to the data possessed by insurance companies. The field data will be data from different industries that were not possessed by insurance companies previously, such as vitals data and equipment operation data. The knowledge referred to means analysis expertise to enable identification of information such as accident warning signs and causal relationships between field data and accidents.

However, the issues above are being steadily overcome by technological advances. Specifically, the Internet of Things (IoT) enables data to be acquired from sensors attached to various devices and people. Massive quantities of data gathered from the IoT can be analyzed by artificial intelligence (AI) and big data analysis technology to make policy-specific accident predictions and to extract knowledge indicating how to avoid or reduce the risk of these accidents. The use of these technologies will enable the construction of risk analysis models that reflect knowledge.

The service ideas above were refined to create a service concept for proactive insurance. The service concept consists of the following three component elements.

Expressing the service concept as a business model, the feasibility of the business was verified theoretically. Specifically, the stakeholders and resources that would be needed were identified, and the business value provided for each stakeholder was checked (since the existence of value for each stakeholder is a necessary condition in a business ecosystem that produces value from multiple organically linked stakeholders). For policyholders, the field data provided enables them to receive the proper preventive assistance services according to specific risks, helping them prevent accidents as a result. For insurance companies, avoiding and reducing risks enables the optimization of claims payment expenditures, and can lead to the differentiation of products in the form of proactive insurance services. For service platform providers such as Hitachi, obtaining IoT data and data measuring the effect of preventive assistance enables the creation of more advanced risk analysis models.

Hitachi investigated specific examples of IoT-driven proactive insurance based on the service concept it created using NEXPERIENCE. The following sections present medical insurance as an example of the relationship of people with the IoT, and insurance for power companies as an example of the relationship of things with the IoT.

While the value provided by traditional medical insurance is primarily the payment of claims to policyholders when medical issues arise, the value of proactive medical insurance is primarily in reducing medical costs through the prevention and early detection of medical issues.

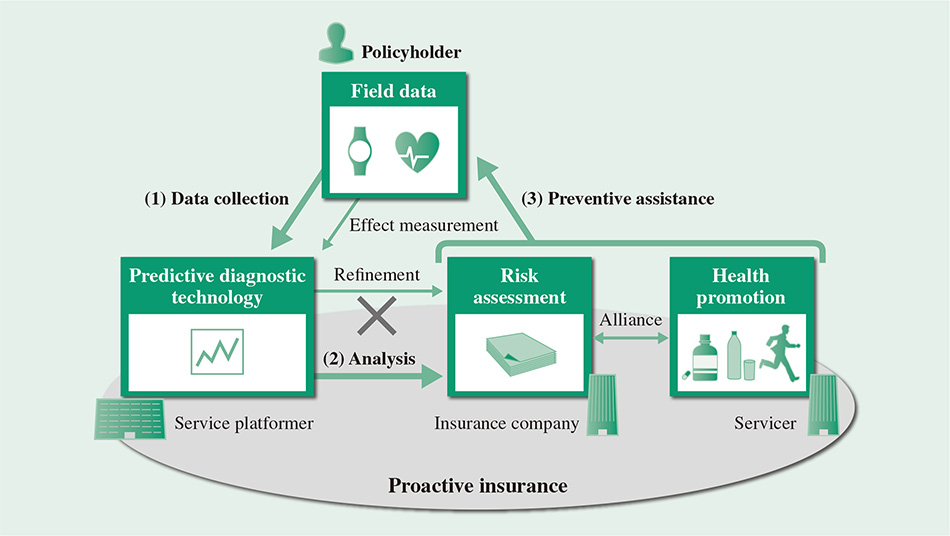

Fig. 2 shows an example of how proactive medical insurance could be implemented.

The data to be collected will include vitals data from sources such as wearable terminals, medical statement data from outside institutions, and test specimens from the policyholder.

The collected data will be used to provide detailed information about the policyholder's current health status, as well as to predict future risks of medical issues.

Medical issues are likely to become severe if left untreated until policyholders feel symptoms. Proactive insurance avoids the risk of unrecognized medical issues by providing policyholders with ongoing risk assessments instead of the single risk assessment provided by conventional insurance at the start of the policy.

Hitachi's medical cost prediction technology and medical condition transition model(3) could be used for risks assessments. These technologies can be used when policies are signed to detect high-risk policyholders and policyholders whose risks could likely be reduced through preventive assistance such as health guidance during the term of the policy.

This proactive approach will enable policyholders and insurance companies to respond to risks in a preventive manner. For example, it could be used to help develop medical insurance products with riders for assistance with medical costs and service fees spent on presymptomatic prevention. When providing preventive services or effective health guidance, the services should ideally be provided in coordination with the health promotion industry or food industry, so NEXPERIENCE has been used to research the creation of business models that span multiple industries.

Fig. 2—Proactive Medical Insurance.

Proactive medical insurance consists of data collection that collects field data such as vitals data; analysis that uses predictive diagnostic technology to assess risks; and preventive assistance that promotes health through alliances with servicers.

Proactive medical insurance consists of data collection that collects field data such as vitals data; analysis that uses predictive diagnostic technology to assess risks; and preventive assistance that promotes health through alliances with servicers.

One of Hitachi's strengths is its successful track record of work on public infrastructure that it has accumulated over many years, such as its work in the power industry. In addition to building power plants, Hitachi also has a wealth of accumulated field data and knowledge obtained through the operation of systems for power generation, transmission, and distribution.

So it may be possible to provide proactive insurance for power companies by taking maximum advantage of such Hitachi strengths.

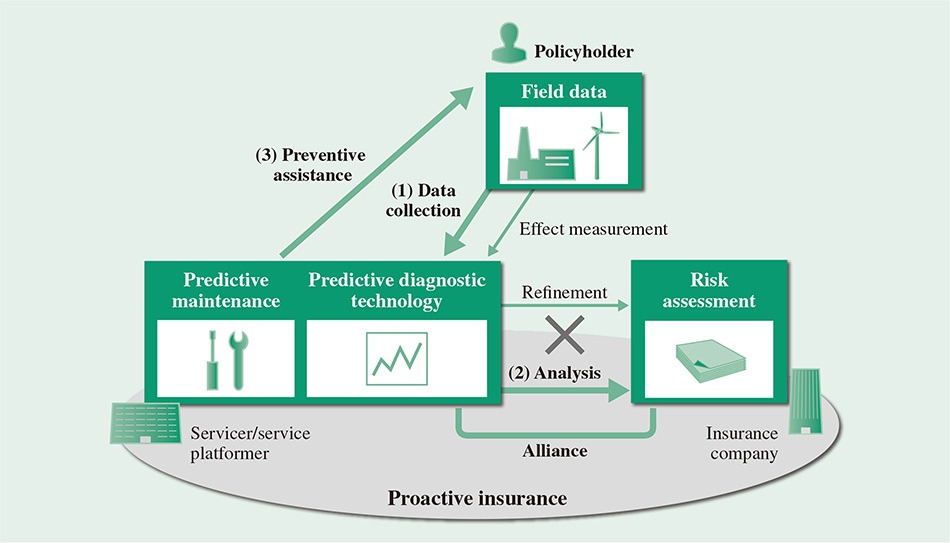

Fig. 3 shows an example of a service that could be provided by combining Hitachi's work in the power industry with insurance.

Along with building power plants and power transmission and distribution systems, Hitachi also provides power companies with predictive maintenance services designed to prevent damage from becoming severe by identifying accident warning signs and performing maintenance before failures occur. Combining Hitachi's predictive maintenance-based work in the power industry with insurance will enable proactive services to be provided. For example, proactive insurance premiums could be calculated dynamically in accordance with risk assessment results determined over the course of predictive maintenance processes, giving power companies an incentive to use Hitachi's preventive assistance or their own accident prevention measures.

Providing proactive insurance will involve collecting facility video data and environmental data such as terrain and climate data, and using Hitachi's remote monitoring systems to collect structured data such as equipment operation states, repair histories, and maintenance histories.

Using Hitachi's predictive diagnostic technology to assess specific risks from the collected field data will enable predictive maintenance and the detection of accident warning signs.

For power companies whose consumers demand a high-quality power supply with either no power failures or rapidly restored service after failures, this proactive approach will help stabilize operations by improving availability factors. It will also help insurance companies optimize their claims payment expenditures by reducing accident rates.

Fig. 3—Proactive Insurance for Power Companies.

Proactive insurance for power companies consists of data collection that collects field data such as device operation information, analysis that uses predictive diagnostic technology to assess risks, and preventive assistance provided through predictive maintenance.

Proactive insurance for power companies consists of data collection that collects field data such as device operation information, analysis that uses predictive diagnostic technology to assess risks, and preventive assistance provided through predictive maintenance.

Hitachi has created a business model proposal in the form of a service catalog containing the services described above. Using this service catalog as a general model during collaborative creation activities with insurance companies can be expected to have the following benefits.

Collaborative creation activities with insurance companies need not be limited to the insurance industry. Working with the industries Hitachi excels in (such as energy, construction machinery, and healthcare) to create new added value that spans multiple industries will lead to the creation of Social Innovation Businesses.

This article has presented some examples of proactive services in the insurance industry. Providing proactive services to various industries could help insurance companies predict accidents and prevent medical issues, fundamentally changing the role that insurance companies play in society.

Using IoT sensing technology and highly accurate prediction technology, Hitachi wants to provide proactive services through collaborative creation activities with insurance companies. Hitachi would like to continue to work with insurance companies to help provide safe and secure public infrastructure systems.