Digital-driven Financial Innovation -FinTech & Beyond-Volume 66 Number 1 January 2017

Digital-driven Financial Innovation -FinTech & Beyond-Volume 66 Number 1 January 2017

The emergence of highly convenient financial services epitomized by the term “FinTech” is driving major changes in consumer awareness. Meanwhile, advances in digital technology are giving rise to innovation and competition on a global scale in a variety of fields. This issue covers initiatives aimed at achieving digital financial innovation, with a particular focus on presenting possibilities that draw on the technologies and know-how of Hitachi and its links with a wide range of customers.

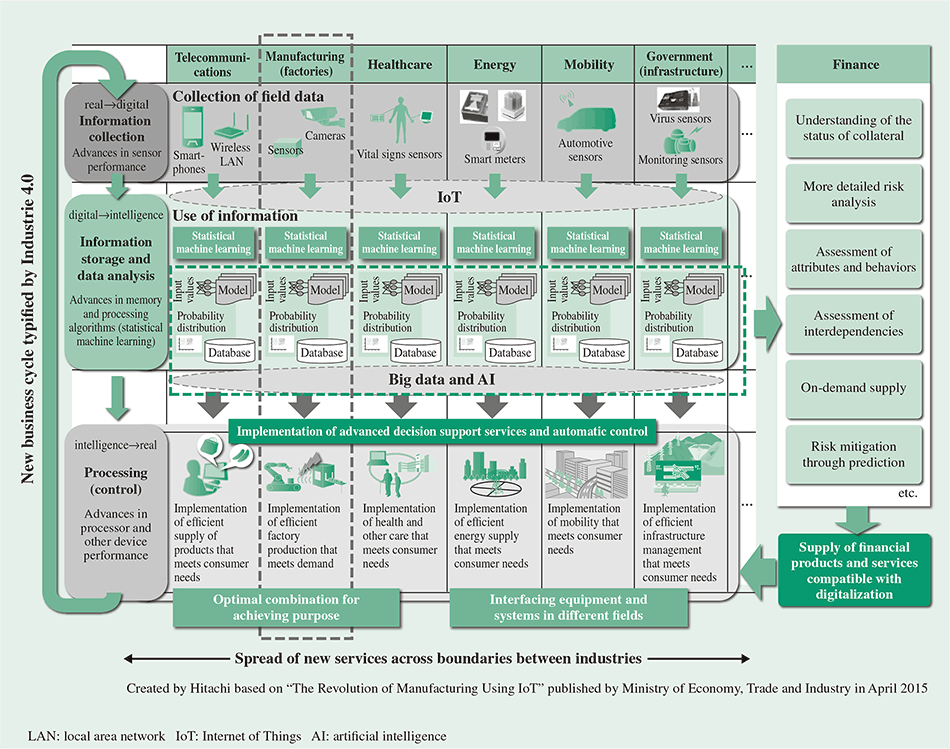

As use of smartphones spreads throughout society and rapid progress is made in technologies such as big data and AI, there is rising interest in FinTech, which creates new services that combine these information technologies with financial services.

Hitachi is focusing on the financial sector as one of the core areas of its Social Innovation Business.

Along with the key topic of financial technology (FinTech), the information technology (IT) and business models used for financial services have become topics of unprecedented interest. Although people are familiar with financial IT in terms of bank automated teller machines (ATMs) and making payments at branches and over the Internet, news articles about system consolidations taking place as a result of bank mergers are not something that particularly excite the interest of ordinary consumers.

We are about to see a complete transformation in the way we exchange and track data and assets across industries. Creating standards for a cross-industry distributed ledger has the opportunity to revolutionize the way we do business, increasing trust, accountability and transparency while simultaneously streamlining business processes. With distributed ledgers, virtually anything of value can be tracked and traded and in a permanent, secure way that makes it easier to create cost-efficient business networks without requiring a centralized point of control.

SINCE the introduction of a negative interest rate policy, Japanese banks and other financial institutions have been facing a downturn in their revenues due to lower lending rates and investment yields, with many predicted to declare losses or lower profits for the fiscal year ending in March 2017.

Faced with this business environment, many financial institutions have adopted the use of financial technology (FinTech) as their immediate strategy, while boosting non-interest income and the use of information technology (IT) for operational efficiencies.