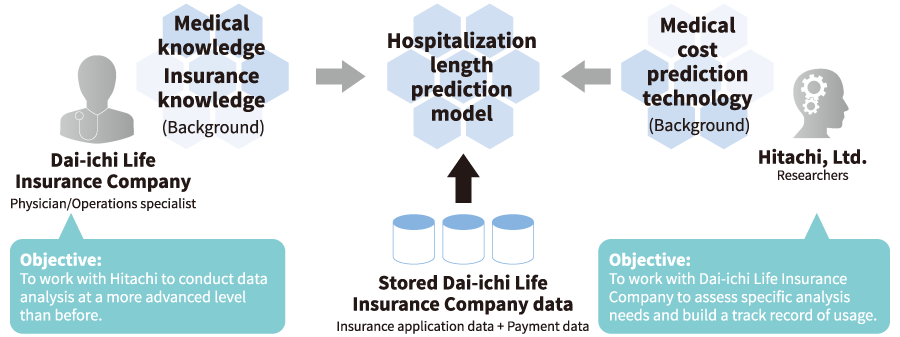

1. Initiatives in Medical Big Data — Joint Research with Dai-ichi Life Insurance Company —

Today, the life insurance industry is focused on developing more advanced risk assessment methods and new products using medical big data such as checkup results and medical compensation statements (insurance claims). Because of its strengths and proven track record in medical cost prediction and other medical data analysis technology, Hitachi has taken on the challenge of creating a risk analysis business for insurance companies.

Currently, Hitachi is conducting joint research with The Dai-ichi Life Insurance Company, Limited on establishing medical big data analysis technology and building a database of use cases. A model was developed for predicting the future length of hospitalization by illness based on a patient's health status when obtaining insurance by analyzing Dai-ichi Life Insurance Company's database of notifications and checkup information received when applying for insurance in comparison with the actual payment information.

The results were used to revise the underwriting criteria to allow eligibility for applicants who have high blood pressure-related ailments, who previously were turned down for insurance because their hospitalization risks were thought to be too high, and enabled the company to successfully acquire new customers.

Looking ahead, Hitachi will strive to develop technology for predicting future changes in medical conditions from changes in the health status over multiple years for developing even more advanced risk analysis technology solutions for the insurance industry.