Rising Expectations for Blockchain to Enable Direct Transactions

Naoyuki Iwashita

Professor, Kyoto University School of Government

Graduated from the Faculty of Economics, Keio University in March 1984. Joined the Bank of Japan in April of the same year. Transferred to the Bank of Japan’s Institute for Monetary and Economic Studies in July 1994, where he spent approximately 15 years engaged in research into information security technology for the finance sector. In 2009 he was appointed General Manager of the Shimonoseki Branch. In 2011, he moved on to Hitachi, Ltd. In 2013, he moved back to the bank and served as head of the Center for Advanced Financial Technology. In April 2016, he was appointed the inaugural head of the newly established FinTech Center. He left the Bank of Japan in March 2017 and took up his position as a professor at the Kyoto University School of Government in April of the same year.

Cho:Blockchain is highly anticipated as the technology platform that underpins virtual currencies. As its name suggests, blockchain consists of a chain of blocks, each of which holds records of transactions. Blockchain refers to the technology used for storing these blocks along with other information, including hash values representing the content of the blocks and a public key, in time-series order, and using a peer-to-peer (P2P) structure (consisting of multiple nodes communicating as equals) to manage transactions across a large number of computers. By providing a reliable way to share transaction records, blockchain enables a shift from centralized transactions (which are handled through an intermediary) to decentralized transactions (which take place directly between users). In other words, a key feature of blockchain is that it can be used to transfer or liquidate financial assets without having to go through a central management server.

Two of the great benefits of this are a significant reduction in infrastructure and intermediary costs due to the lack of any need for a large central system, and the ability to conduct transactions impartially and transparently through a mechanism that is largely immune to tampering. Work is also underway on utilizing these characteristics in the development of smart contracts (programs coded into a blockchain that execute actions relating to financial assets automatically), a mechanism that is attracting considerable interest for its potential to serve as a platform for interoperation, not only within the financial sector, but also across a variety of other industries and business models.

Professor Iwashita, what is your view of where blockchain is at present?

Iwashita:The Banking Law of Japan has undergone three revisions over the last decade. Two of these revisions took place within the last two years, and both of them were intended to urge traditional banks to embrace FinTech. This shows how great the Japanese government’s expectations are for banks to utilize FinTech to improve their business.

Meanwhile, annual global investment in FinTech has totaled around two trillion yen for each of the last three years.

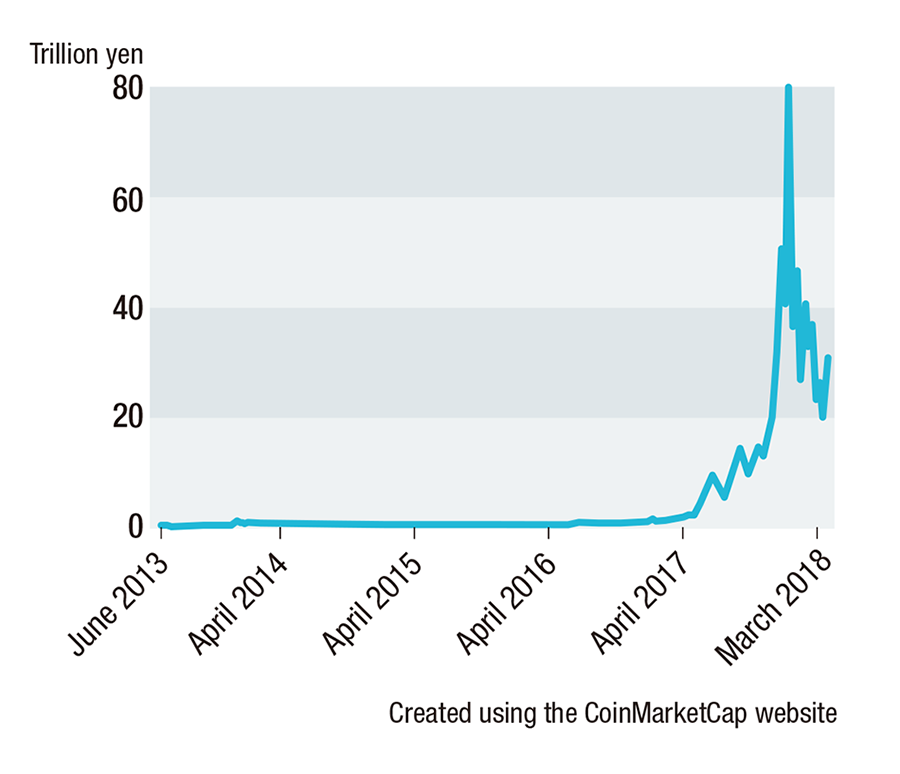

With the growing number of Bitcoin users, much attention also has been focused on that currency’s split and its wildly fluctuating price. Along with Bitcoin, there are more than 1,600 “altcoins” (non-Bitcoin virtual currencies), including Ethereum and Ripple, with a current total market valuation for all virtual currencies of around 30 trillion yen (as of the end of March 2018). However, this is seen as something of a bubble that is being sustained by speculation (see Figure 1).

As for blockchain itself, it has yet to reach the point where it is ready to become part of people’s daily lives. The technology is still under development and regulations are failing to keep up. Nevertheless, there is growing expectation toward blockchain, one of the core technologies of FinTech.

Figure 1Trend in Total Market Valuation of Virtual Currencies

Blockchain’s Future is More than Virtual Currencies

Cho:The mention of blockchain tends to bring to mind virtual currencies, which use public blockchains in which anyone can participate. In contrast, two blockchain models that are expected to be used by companies in the future are private blockchains and consortium blockchains. Private blockchains are used for conducting more robust and secure transactions with restricted participation, and consortium blockchains are used for handling payments or other transactions between a limited number of companies or individuals. How do you view these two different models?

Iwashita:You can design new practical services for doing business by private or consortium blockchain if you utilize the advantages of public blockchain, such as electronic signatures, encryption, anti-tampering, and other capabilities.

There are a variety of possible use cases out there. As virtual currencies are digital, they make it possible to trace the flow of money. The UK government is currently looking at putting this feature to use in the field of social security. One example might be using a public blockchain to confirm that money correctly reaches people who receive welfare. Another use involves taking advantage of blockchain’s immunity from tampering by using it to hold people’s degree certificates.

The spread of blockchain is gathering pace, including the launch in January 2018 by Nasdaq, Inc. and the New York Stock Exchange of an exchange-traded fund devoted to blockchain companies. Proof of concept (PoC) testing on the use of blockchains and smart contracts for securities trading is also being undertaken by organizations including the company responsible for handling settlements in Japan’s financial markets, Japan Securities Depository Center, Inc., which is considering adopting such systems.

Nevertheless, certain issues are also becoming evident. Whereas cash provides a tried and true basis for settling payments, using virtual currency in place of cash for blockchain-based settlement of securities transactions would still leave open the question of how to guarantee the credit of these transactions. One proposal for doing this has been for the central bank to issue a digital currency and to use blockchain to perform simultaneous settlement of securities with this digital currency.

Practices like this could enable the central bank, financial institutions, and FinTech companies that deliver a diverse range of services to engage with each other over the Internet, made more robust by the use of blockchain, and in doing so could, I believe, open up a whole range of new possibilities.

Hitachi’s Work on Private and Consortium Blockchains

Cho:Prior to blockchain, Hitachi’s involvement in FinTech has encompassed enhanced channels and mobile integration in the field of interfaces, development in areas such as application programming interfaces, the development of security and authentication techniques that take the form of shared platforms, and the provision of services that utilize big data and artificial intelligence (AI). Since the second half of FY2015, this has included a focus on blockchain research and development. Mr. Yamamoto, could you please tell us about the work being done by Hitachi?

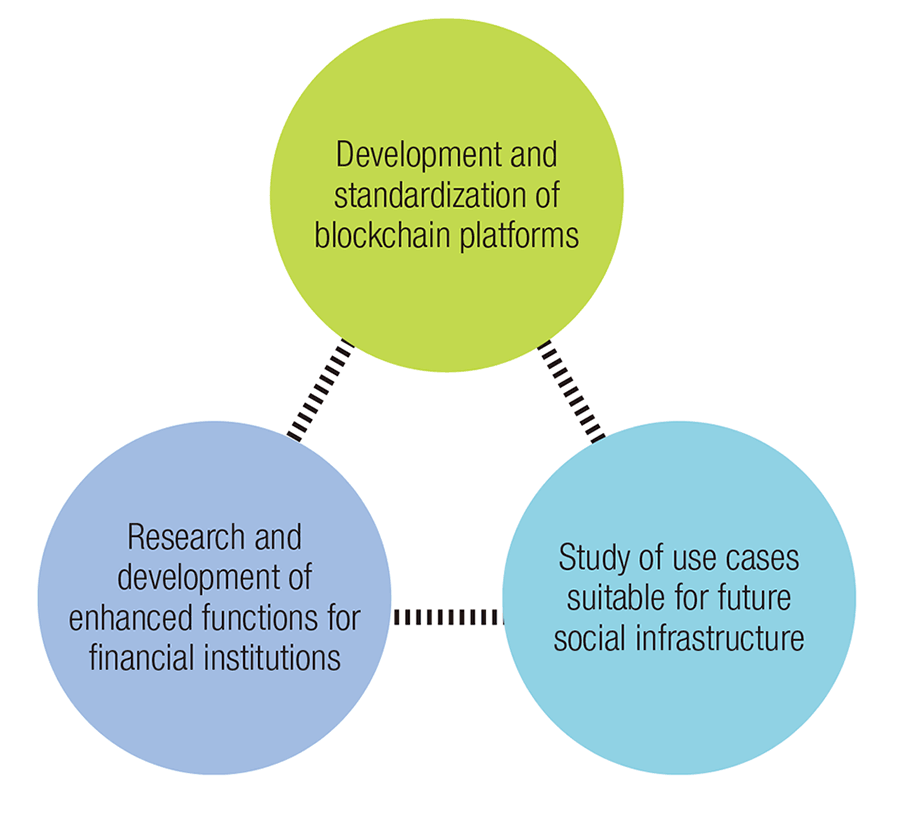

Yamamoto:As Hitachi is primarily engaged in the business-to-business sector, we are mainly involved in developing systems that work on consortium or private blockchains, although we have not lost sight of the benefits of public blockchains (see Figure 2).

To begin with, we are working to verify and enhance the functions provided by blockchain platforms for applications such as business process improvement in the finance industry. This includes participating in Hyperledger*, a consortium-based project promoted by The Linux Foundation* involving more than 190 companies that aims to develop and standardize open source resources for blockchains. Hitachi has been a premier member of Hyperledger since it was launched in February 2016.

The aim of Hyperledger is to develop systems based on blockchain technology for business use. Ahead of this, Hitachi has been collaborating with MUFG Bank, Ltd. since August 2016 on PoC testing in Singapore that uses blockchain for issuing and settling electronic checks, and has used this to identify the technical, security, business, legal, and other issues that need to be dealt with for commercialization.

To put blockchain to work across all industries, not only financial services, Hitachi also deployed a cloud service on its Lumada Internet of Things (IoT) platform in May 2017 that provides the technical resources required for blockchain-based PoC testing using Hyperledger Fabric. Having established this infrastructure, Hitachi was selected in October 2017 as a partner vendor for the newly developed blockchain integration platform of the Japanese Bankers Association. Along with commencing PoC testing, Hitachi has also started joint trials with Mizuho Financial Group, Inc.

Cho:Although the finance industry is the main focus at present, by providing the required people with the goods and services they need in a timely manner, we believe that these initiatives by Hitachi are helping to bring about a Super Smart Society that aims to cater to the various needs of the public in ways that are finely tuned to the circumstances.

- *

- Hyperledger and Linux Foundation are registered trademarks of The Linux Foundation.

Figure 2Hitachi’s Involvement with Blockchain Hitachi is working on three initiatives in parallel.

Hitachi is working on three initiatives in parallel.

Tsugio Yamamoto

Vice President and Executive Officer, CEO of Financial Institutions Business Unit, Hitachi, Ltd.

Joined Hitachi, Ltd. in 1978. He was appointed chief project manager of the System Technology Department, No. 1 Financial Systems Division, Financial Systems Business Unit, System Solutions Group in 2001; general manager of the NEXTCAP Solution Department, Financial Solutions Business Unit, Information & Telecommunication Group in 2004; COO of the Systems & Services Department, Information & Telecommunication Systems Company, Information & Telecommunication Systems Group in 2015; CEO of the Financial Institutions Business Unit and CEO of the Government & Public Corporation Business Unit in 2016; and to his current position in 2017.

Various Use Cases, Including Cross-border Transactions and Supply Chains

Cho:Given that wider adoption of blockchain will require a portfolio of use cases across industry boundaries, what specific applications do you anticipate?

Iwashita:As the emergence of Bitcoin has made possible the seamless exchange of financial assets across borders, I expect to see it being used in areas like cross-border transactions and international aid, where barriers have presented difficulties in the past.

For example, in Estonia, which is recognized for its advanced IT, it is possible not only for residents, but also for people living overseas to access government services via the Internet. What has made this possible is an identity verification system that is based on a government-issued smartcard. Personal identification in Japan has in the past involved the use of personal seals, but this system is not recognized internationally and the seals are now so easy to counterfeit that they have become obsolete as a form of identification. If blockchain were used for personal identification, I believe it could be widely utilized for purposes such as commercial transactions and real estate sales.

Cho:Blockchain certainly makes possible all sorts of cross-border transactions via the Internet. Hitachi also has started working on using blockchain in a supply chain management system. What advantages are gained by using blockchain technology?

Yamamoto:In the case of a supply chain, when a manufacturer receives an order for one of its products, for example, it initiates the ordering process by sending out details such as quantities, delivery dates, specifications, quality criteria, and other requirements for the parts it needs to procure and requests its suppliers to provide quotes. On receiving an order, the supplier passes the information on to its manufacturing division to produce the goods ordered and delivers them to the purchaser. On receiving the goods, the purchaser’s accounting department then processes the payment which is paid to the supplier via a financial intermediary. If this flow of ordering and payment data that passes between the various sites and departments is handled in a blockchain, this means that all of the different organizations and departments can have shared access to the same information.

The data cannot be erased or altered once it has been made public, and it builds up over time. Moreover, the failure of any of the computers linked together in the blockchain does not result in loss of data because it is still held by all the other computers.

If, for example, the manufacturer’s product was subjected to a recall, information on which suppliers supplied the parts associated with the recall could be accessed immediately. It should also be possible to determine whether the supplier has also supplied the same part to other manufacturers. The same applies to financial institutions where the ability to keep track of the movement of funds and payment dates and amounts for each supplier is a major advantage.

Possibilities of Smart Contracts, Essential for Cross-industry Coordination

Cho:I believe that smart contracts coded into a blockchain and used for the automatic execution of actions involving financial assets are of particular importance when different industries are involved. Professor Iwashita, could you please give us your take on smart contracts?

Iwashita:The first example of smart contracts came when Ethereum, one of the “altcoins,” incorporated them into its blockchain. By coding programs into the blockchain, and taking advantage of its feature of immutablility, smart contracts provide a way to execute authentication, contracts, and other actions automatically (see Figure 3).

The replacement of the seal on contracts by an electronic signature that uses a private key together with the ability to execute cross-border contracts automatically, as we mentioned earlier, opens up many new possibilities. Naturally, the legal force of smart contracts remains a matter for individual countries to debate. The problem is similar to that of assigning responsibility in the event of an accident involving an autonomous vehicle, and we may need to devise global rules about how to resolve disputes that arise over smart contracts and who is responsible.

Yamamoto:As the name suggests, the concept of smart contracts has also been adopted for buying and selling over the Internet, and this is an area where the ability to execute contracts in a blockchain automatically is crucial.

For example, further advances in the IoT should make it possible to provide shared access to vehicle driving data in a blockchain, data such as fuel consumption, distance traveled, and instances of sudden acceleration. By making this information available not only to the vehicle owner and manufacturer, but also to others such as the vehicle insurer and dealer, it becomes possible for the insurer to offer policies that are tailored to the needs of individual drivers, and for the information to be utilized by dealers when performing vehicle inspections and other routine servicing. Furthermore, by automating this process, timely contract fulfilment can be achieved without human intervention.

Figure 3Smart Contracts Smart contracts can automate the execution of potential trades or contracts coded into a blockchain by expressing the conditions for triggering the corresponding action (trade or similar) as a program, thereby providing the ability to link a variety of different activities together seamlessly.

Smart contracts can automate the execution of potential trades or contracts coded into a blockchain by expressing the conditions for triggering the corresponding action (trade or similar) as a program, thereby providing the ability to link a variety of different activities together seamlessly.

Issues and Prospects for Wider Adoption of Blockchain

Toshiya Cho

Senior Evangelist, Financial Systems Sales Management Division, Financial Institutions Business Unit, Hitachi, Ltd.

Joined Hitachi, Ltd. in 1985. After working as a systems engineer for the securities industry, in CRM solution development for financial institutions, in business consulting, and as head of the Financial Innovation Center, he took up his current position in 2018. He is a member of the Governing Board of Hyperledger hosted by The Linux Foundation. He is also a visiting lecturer at the University of Tsukuba.

Cho:Something you mentioned earlier was that greater collaboration between industries has the potential to turn the payment process into a bottleneck. It seems that using a legally authorized digital currency would make a lot of sense.

Iwashita:Central banks around the world are looking into the idea of issuing digital currencies. It seems that paper money and paper contracts are set to disappear in the future, although the yen is sure to continue as a currency unit for trading. The Bank of Japan has issued an opinion stating that, while a legal digital currency is technically possible, it is not yet being considered.

Nevertheless, I believe that some sort of digital currency will be necessary to enable real-time payments on blockchain. However, this does not necessarily have to be provided by a central bank. It would be interesting to see what happened were Hitachi to launch its own Hitachi-coin.

Yamamoto:The elimination of paper money might be a problem for us given that Hitachi produces automated teller machines. Then again, with the Modi government in India having announced the removal of high-denomination notes, the transition to digital currency can be already thought of as a global trend. In any case, we need to recognize this as a business opportunity and come up with new services.

Cho:That is right. Are there any other issues of concern?

Iwashita:The current state of blockchain has many similarities to the Internet in its infancy, 30 years ago, with much technical innovation still to come. Regulation and the clarification of interests must take place in parallel with this, and we need to seek a consensus through the stakeholders working together.

Cho:What about technical hurdles?

Yamamoto:Improvements are still needed in areas such as consensus mechanisms and the speed of processing, with numerous other issues also remaining that relate to practical applications, such as how to keep information that is shared separate from information that is confidential, but on the same blockchain.

A variety of organizations are independently building frameworks, including Hyperledger with which we are involved, and an important task for the future will be to integrate these or make them mutually compatible.

Iwashita:I find it very encouraging that you are a member of the Hyperledger Governing Board representing Hitachi, and also a member of the International Organization for Standardization (ISO) committee working on blockchain standardization. I look forward to your pushing ahead with blockchain innovation and standardization.

Cho:Thank you very much. Hitachi intends to continue its efforts to make blockchain part of the fabric of society as we work toward Society 5.0, the Super Smart Society, with an advanced level of cross-industry coordination, and I thank you for your ongoing support.