Following the 2015 acquisition of Ansaldo Breda S.p.A. (now Hitachi Rail S.p.A.) and Ansaldo STS S.p.A. (now Hitachi Rail STS S.p.A.) as group companies by the Railway Systems Business Unit of Hitachi, Ltd. the business unit was further restructured in 2019 into three “business lines,” comprised of rolling stock, signalling and turnkey solutions, and operation, service and maintenance. The aim is to boost competitiveness by combining the strengths of each company. Hitachi is expanding production operations around the world. By deepening and coordinating the respective globe-spanning business lines, the intention is to deliver new value through innovation to meet societal needs and build better societies. This article describes the current status of development and future development strategy of each business line.

The world’s population is predicted to surpass 10 billion by 2060(1). This growth will make railways’ role of providing mass transit more important than ever. Meanwhile, the world has also undergone a high degree of urbanization over the past century(2).

This trend is forecast to continue, with the expectation that demand for urban transportation, subways, and commuter trains will rise in line with this ongoing urbanization. At the same time, the rising carbon dioxide (CO2) emissions that will accompany this population increase and urbanization pose a problem for society, meaning that ever greater expectations are being placed on railways as a means of transportation with low CO2 emissions(3) (see Figure 1). Railways are also being called on to adapt to the new social landscape brought about by the COVID-19 pandemic that has been spreading around the world from late 2019 through 2020 and with this is likely to come an increase in new requirements such as automatic train operation or ticketless travel.

Given this background, an annual growth of 3% or more is forecast for the railway systems market across the four areas of signalling and control, infrastructure, rolling stock, and services(4) (see Figure 2).

Ansaldo Signalling and Transportation Systems S.p.A. (Ansaldo STS S.p.A., now Hitachi Rail STS S.p.A.), the company that handles the signalling system and turnkey business, became a 100% subsidiary of Hitachi, Ltd. in January 2019, transforming Hitachi into a railway systems integrator with a business scope that includes turnkey solutions(5). To boost competitiveness by combining the strengths of the different group companies, the Railway Systems Business Unit subsequently shifted to a global organizational structure in April 2019 that is made up of three business lines: rolling stock (RS), signalling and turnkey solutions (S&T), and operation, service, and maintenance (OS&M). This article presents an overview.

Hitachi’s railway business is approaching the 100th anniversary, in 2021, since Hitachi acquired the Kasado shipyards of Nippon Kisen Co., Ltd. and established the Kasado Works for building rolling stock in 1921. Mito Works established in 1940, got its start as a new manufacturing site in 1961 when the escalator and elevator division was transferred from the old Kokubu Works and combined with the rolling stock division. In the case of electrical systems, Hitachi has supplied numerous products to Japan’s public and private railway businesses, including insulated-gate bipolar transistor (IGBT) inverters, battery-driven systems, and autonomous decentralized train integrated system (ATI) for transmitting rolling stock information. The rolling stock division, meanwhile, successfully expanded its order book by leveraging the technologies of friction stir welding (FSW) and aluminum double-skin construction developed in the late 1990s. Hitachi Rail Europe Ltd. was established in 2003, winning a contract in 2005 to supply Class 395 rolling stock in the UK as well as maintenance-inclusive package contracts covering the Class 395, the Intercity Express Programme (IEP), and commuter trains in Scotland. Ansaldo Breda S.p.A. (now Hitachi Rail S.p.A.) joined the group in 2015, bringing additional production sites and broadening the range of competitive products.

In the signalling and services business, Hitachi has developed traffic management systems and ticketing systems such as the Midori-no-madoguchi*1 system of the East Japan Railway Company, and then, in the field of signalling control, Hitachi also developed radio train control systems such as the communication-based train control (CBTC) and the advanced train administration and communications system (ATACS). In the 2000s, Hitachi coordinated the operations of group companies and sites around the world to expand its operations globally, with activities including the delivery of smartcard-based ticketing systems such as Suica*2.

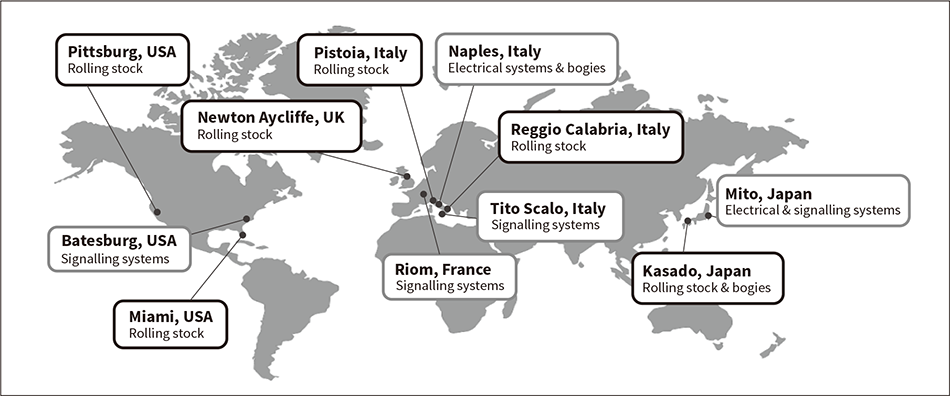

As of August 2020, Hitachi’s railway business has 11 production sites around the world, and is working to expand further as a leading supplier of total solutions in the railway systems business (see Figure 3).

Fig. 3—Map of Production Facilities

Hitachi’s railway business has 11 production sites spread across the world. Its staff of approximately 12,000 people, who work at offices, factories, and service and maintenance centers around the world, are engaged in more than 50 different projects.

Hitachi’s railway business has 11 production sites spread across the world. Its staff of approximately 12,000 people, who work at offices, factories, and service and maintenance centers around the world, are engaged in more than 50 different projects.

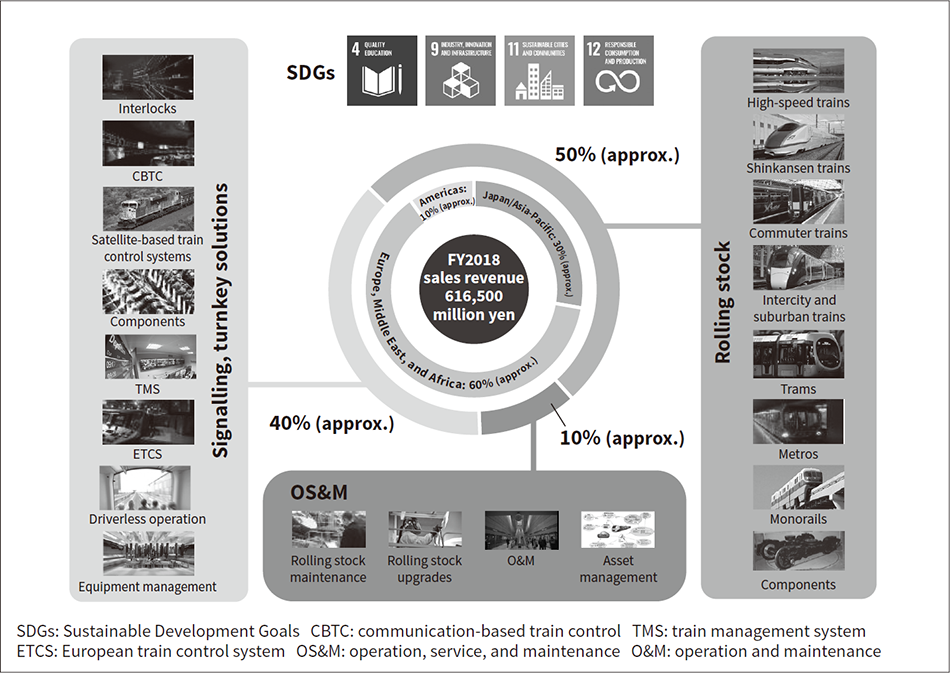

Fig. 4—Structure of Railway BU

Hitachi’s Railway Systems Business Unit deals with products across a wide range of categories and is made up of three business lines: rolling stock, signalling and turnkey solutions, and operation, service, and maintenance.

Hitachi’s Railway Systems Business Unit deals with products across a wide range of categories and is made up of three business lines: rolling stock, signalling and turnkey solutions, and operation, service, and maintenance.

Hitachi’s railway business is split into three “business lines” to serve the international railway market (see Figure 4).

These three business lines also work together on development as they strive to deliver new value through innovation to meet societal needs and build better societies in their role as a system integrator for the mobility sector engaged in business to consumer (B-to-C) as well as business to business (B-to-B) activities.

The A-Train concept was devised in the runup to the 2000s. Based on carbodies built using aluminum double-skin extrusions and the FSW techniques, A-Train rolling stock features double-skin construction in which aluminum extrusions are formed as box-shaped hollow sections. This represented a ground-breaking improvement in manufacturing practice, reducing both lifecycle costs and the load on the environment thanks to the carbodies not requiring painting and combining high rigidity with light weight, also enabling a rigorous approach to reducing the number of parts through the use of self-organized modules. Hitachi also developed a production technique involving a five-axis machining system for the flexible shaping of aluminum for rolling stock front-end structures, enabling a wide range of customer requirements to be satisfied with high quality(6).

In response to the very demanding requirements for lighter weight, lower noise, and tunnel entry micro-pressure wave performance in Shinkansen trains, Hitachi also developed its own simulation techniques that it utilized in tens of thousands of automatic calculations for the optimal design of carbody structures.

In 2015, Hitachi led the world by commencing on-track trials of bi-mode rolling stock developed for the UK in which electric power is supplied via a pantograph on electrified track and from an engine-generator on non-electrified track. More than 1,200 of these have entered commercial operation(7).

Along with the international attention focused on the United Nations’ Sustainable Development Goals (SDGs), CO2 emission reduction targets for 2030 to 2050 are being reappraised. This has led to demand for the development of new energy-efficient rolling stock of various different types, with a number of such plans now getting underway in earnest. These include plans to use fuel cells as well as batteries in place of the engine-generator in bi-mode rolling stock running on non-electrified track, or for fitting batteries into conventional trains so that they can run on non-electrified track.

Countries such as the UK, India, and USA have plans to introduce high-speed rail to provide an alternative to air travel, while Panama and other emerging countries are planning monorails as an alternative to buses.

Developments aimed at establishing rolling stock platforms play an important role in satisfying these needs. Similarly, the establishment of globally standardized IT infrastructure that can be utilized at all production sites in real time can shorten delivery times and cut costs in the development, design, and manufacture of this rolling stock. Hitachi intends to continue pushing ahead with this use of IT on a global basis.

Use of inverters in rolling stock drive systems began in the 1980s. Since it led the world by supplying the first IGBT inverter to the Teito Rapid Transit Authority (now Tokyo Metro Co., Ltd.) in 1992, Hitachi has made rapid progress on making this equipment smaller and more highly efficient(8). Hitachi was also among the first to get involved in railway system applications for leading-edge silicon carbide (SiC) power devices(9), (10), and has produced a number of power converters that use these devices. Other high-performance component developments include induction motors (IMs) with world-class overall efficiencies of more than 97% and permanent magnet synchronous motors (PMSMs) with overall efficiencies of more than 98%(11). Hitachi has also made enhancements to its inverter control and other technologies by developing techniques for the detailed analysis of losses in power converter circuits and motors that utilize precise and sophisticated simulations.

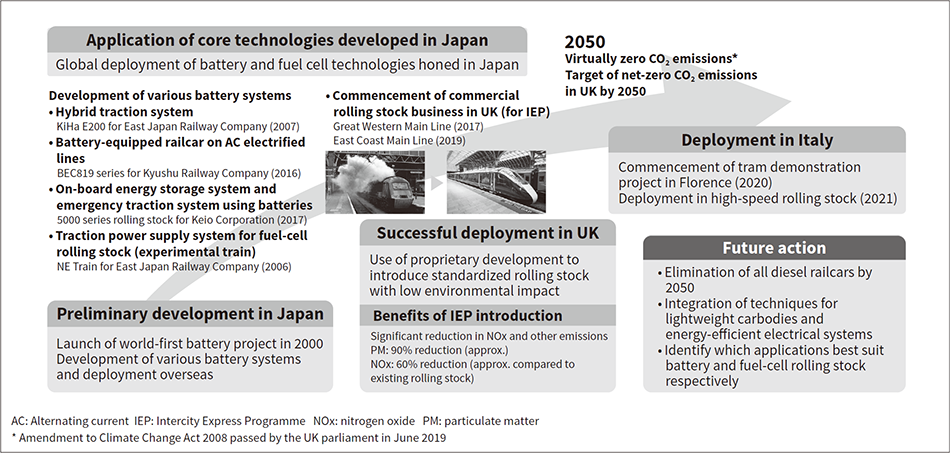

In the field of battery-driven systems, the KiHa E200 series rolling stock delivered to East Japan Railway Company in 2007 featured a series hybrid drive system that combined batteries with a diesel engine to reduce railcar fuel consumption(12). By incorporating battery control into traction systems on electric railcars, Hitachi has also succeeded at storing energy from regenerative braking and extending its speed range and has further developed these capabilities into a high-efficiency regeneration system that maximizes the use of electrical energy. Another success was the commercialization of battery-driven rolling stock that is able to run on non-electrified sections of track using the stored energy in on-board batteries charged when running on track with alternating current (AC) overhead wires. This system was fitted to the BEC819 series rolling stock supplied to Kyushu Railway Company in 2016(13).

With its extensive range of electrical products for rolling stock, Hitachi can offer systems that are a good fit with customer requirements. To further differentiate itself from competitors, it intends to focus development on producing competitive components, enhancing its analytical techniques, and devising preventive practices encompassing maintenance and lifecycle planning. Further development of key power devices is also planned, including next-generation SiC devices and performance improvements for Si-IGBT.

Europe is seeing an ongoing tightening of environmental regulation, with the UK having passed legislation in June 2019 that sets a target of virtually zero emission of CO2 by 2050. The region is also seeing rising demand for batteries and fuel cells and the automotive sector is expecting wider adoption of electric vehicles. Along with the global deployment of technologies honed on a wide range of products such as its series hybrid drive system, on-board energy storage system, emergency traction system, and battery-powered rolling stock charged from AC overhead wires, Hitachi also aims to supply attractive and environmentally conscious products through collaboration with the car-body division. Meanwhile, the development of fuel cell applications will continue with the aim of further reducing CO2 emissions (see Figure 5).

Fig. 5—Environmental Initiatives Utilizing Batteries and Fuel Cells

Hitachi leads the world in the development of battery and fuel cell technologies for use in railways, including applications in places like the UK and Italy to achieve early compliance with European CO2 regulations.

Hitachi leads the world in the development of battery and fuel cell technologies for use in railways, including applications in places like the UK and Italy to achieve early compliance with European CO2 regulations.

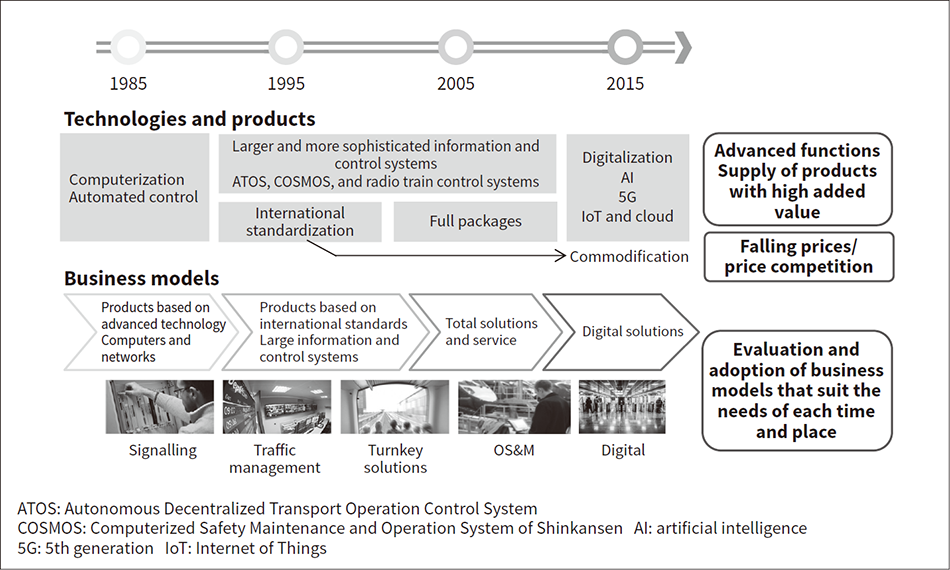

Figure 6 shows technology and market trends in the signalling and turnkey business in Japan and overseas.

Fig. 6—Evolution of Technology and Business Models in Japan and Elsewhere

Hitachi has continued to work on satisfying the needs of the public and advanced technologies since the early days of computerized automation.

Hitachi has continued to work on satisfying the needs of the public and advanced technologies since the early days of computerized automation.

Japan saw ongoing progress on the installation of large distributed control systems from the early 1990s driven by the dramatic rise in the performance of workstations and personal computers and the provision of infrastructure for large high-speed networks. Notable examples include the Autonomous Decentralized Transport Operation Control System (ATOS) and Computerized Safety Maintenance and Operation System of Shinkansen (COSMOS) traffic management systems of East Japan Railway Company and its Shinkansen Automatic Train Control and Interlocking System (SAINT).

Radio train control systems such as ATACS and CBTC were developed for signalling control. This approach reduces the amount of wayside equipment and provides greater flexibility in traffic management, such as single-tracked line-like operation execution in the case of one-line accidents on a double-tracked line, and its introduction is being considered. Radio train control systems have a strong affinity with autonomous train control, and it is anticipated that they will be increasingly adopted as demand for autonomous train control systems increases in the future.

In railway information systems, Hitachi has been developing customer service systems such as the Magnetic-electronic Automatic Reservation System (MARS*3) and transport planning systems. Smartcard ticketing such as the Suica system introduced in 2000 are now an integral part of people’s lives, serving as an important form of electronic money.

Hitachi has been engaged in the development and deployment of a wide variety of systems, extending from control systems to customer service and other information systems. Hitachi started complying with international standards such as European Rail Traffic Management System (ERTMS) and European Train Control System (ETCS) in the 1990s and to this day continues to develop products that comply with such standards.

To ensure that it is able to take on full turnkey contracts for the supply of signalling systems, Hitachi has also been establishing a full package of signalling systems since 2000. This includes installing signalling equipment that complies with international standards and providing total solutions and services that include project management.

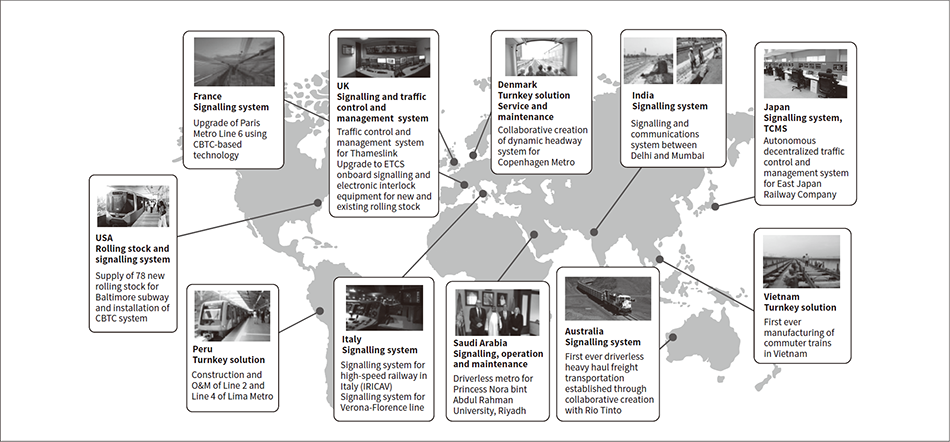

Figure 7 shows the different countries and regions in which Hitachi operates its global railways business together with some of the major systems supplied over recent years.

Fig. 7—Hitachi Systems Installed Around the World

Hitachi has supplied railway signalling systems globally, including turnkey solutions.

Hitachi has supplied railway signalling systems globally, including turnkey solutions.

With its rapidly aging population and low birth rate, the challenges facing Japan and its railway industry include labor shortages resulting from the retirement of experienced staff, an increasing number of people with impaired mobility, and the problem of how to maintain services to depopulated regions. Achieving greater resiliency to natural disasters is also essential. Examples of such disasters include the severe typhoons that have struck the country in recent years as well as earthquakes like the Great East Japan Earthquake.

Meanwhile, future technology trends will include high-level automation that is similar to human operation, such as the use of artificial intelligence (AI) and the new 5th-generation (5G) standards for mobile telecommunications in railway traffic management, the automated operation of rolling stock, and more sophisticated maintenance practices that make use of the Internet of Things (IoT). There are also high hopes for the realization of mobility as a service (MaaS), a new way of thinking about how information and communication technology (ICT) can be utilized to provide seamlessly integrated transportation services. Railways would be expected to play a central role in such services. Accordingly, it is hoped that the adoption in railway systems of the latest technologies described here can help address future social needs and overcome challenges by making possible MaaS and other new approaches to transportation services.

Outside Japan, there is a requirement for compliance with international standards. As signals vendors from countries like China are expected to make aggressive moves into overseas markets in the future, rapid commodification can be expected in these internationally standardized products. There are also high expectations for the use of digital technologies such as AI and 5G to resolve regionally specific issues overseas as well as in Japan.

Given this situation, Hitachi intends to be proactive about incorporating the latest technologies for digitalization into railway systems, and to continue developing and supplying systems with high added value that contribute to society.

The new OS&M organization combines activities and resources in service and maintenance (S&M) for rolling stock equipment and signalling installations with Hitachi’s operation and maintenance (O&M) business, including turnkey solutions, signalling infrastructure, and other facilities. The OS&M organization works in close collaboration with regional sales divisions to present a single face to the customer and strengthen its approach as a global full service provider.

As a fully integrated organization and profit center, the OS&M organization includes global functions for business development, tendering, sales, program management, procurement, quality control, and maintenance engineering. These departments support the entire OS&M organization, which deploys and manages services in local markets by country and region.

Hitachi is developing a series of large-scale railway-related projects around the world, with its OS&M organization encompassing a wide range of products and business areas.The challenge at present is to develop emerging markets, and the role of OS&M will be very important in expanding business share.In the O&M market, the range of services is wide and competition is fierce because the providing of core services such as control center operations, fare collection, facilities management, infrastructure maintenance, station operation, and customer care is the most important.

OS&M intends to consolidate its unique position as a full service provider by utilizing its operational background in mass transit systems to participate in the S&M market for these systems, through opportunities in operator markets, and by developing digital capabilities in order to become a market leader in asset management.

This article has described the progress of Hitachi’s railway business and the current status and future outlook for technology development.

The seven articles in this issue of Hitachi Review describe the development of new trains in the rolling stock business, high-efficiency PMSM systems, an on-board energy storage system that helps to reduce CO2 emissions, technology for automated operation, traffic management techniques, and details of future passenger services and Hitachi’s OS&M business. Hitachi believes that all of the technologies described here will serve as future advanced technologies for its railway business.

Hitachi intends to use these technologies as a basis for continued technical development as it works to build the railway systems that will provide transportation in the world of the future.