The finance industry is experiencing rapid changes, including the rise of new market players typified by non-financial institutions; the emergence of the blockchain, IoT, and other innovative new technologies; and changes in regulation around the world. These changes not only promise dramatic improvements in the quality of financial services that end users can enjoy, but they also present an opportunity to confront societal challenges that have appeared difficult to solve in the past. In addition to the development of products and systems for financial institutions, Hitachi is responding to these societal challenges and industry changes by focusing on collaborative creation with customers to produce innovative solutions for the future world of finance. This article describes Hitachi’s approach to developing new financial solution concepts, and in doing so envisages what finance might look like in the future.

Service Design Research Department, Global Center for Social Innovation – Tokyo, Research & Development Group, Hitachi, Ltd. She is currently engaged in ethnographic research and service design. Ms. Hara is a member of the Japanese Society for Cognitive Psychology, and Human Interface Society.

Business Planning Unit, Financial Information Systems Sales Management Division, Financial Institutions Business Unit, Hitachi, Ltd. He is currently in charge of business and strategy planning for the financial services business.

Customer Co-creation Project, Global Center for Social Innovation – Tokyo, Research & Development Group, Hitachi, Ltd. He is currently engaged in customer co-creation projects in the financial and public sectors. Mr. Nagano is a member of the Institute of Electrical Engineers of Japan (IEEJ).

Service Design Research Department, Global Center for Social Innovation – Tokyo, Research & Development Group, Hitachi, Ltd. He is currently engaged in service design for business incubation. Mr. Akashi is a member of the Service Design Network.

THE finance industry is experiencing rapid changes, including the rise of new market players typified by non-financial institutions, changes in the structure of markets brought about by deregulation, and the emergence of new services based on such innovative technologies as the blockchain and Internet of Things (IoT).

In response to these changes, financial institutions in Europe and America are taking a fresh look at a back-to-basics approach to customers through which they seek to deepen relationships by providing highly-convenient solutions based on a reappraisal of end user needs.

In emerging countries, meanwhile, financial inclusion is improving at an accelerating rate, with the rapid spread of smartphones and the emergence of new technologies such as the blockchain prompting the development of solutions that give the unbanked (those who do not have a bank account) easy access to financial transactions.

Given that the finance industry forms part of the infrastructure of society, it is understood that financial institutions face a variety of new challenges in the form of demographic changes that include an aging population, longer life expectancies, increasing immigration, and urbanization; an increasingly borderless world; and global-level societal challenges such as the threat of conflict and terrorism in various parts of the world(1).

Recognizing these changes in the finance industry, Hitachi is, in addition to its existing work on developing products and systems for financial institutions, also seeking to create innovative solutions for the future world of finance. This article describes the approach adopted by Hitachi for working in collaboration with end users and customers to create new concepts for financial solutions by envisaging how societal challenges and industry changes will affect the future of finance.

Hitachi uses the kizashi method to anticipate future changes in consumer values and to develop attractive services that will suit such an era(2).

The kizashi method works by identifying dynamic social trends and determining what effects those trends will have on people so as to document the potential changes in consumer values that might result. The method is used to develop a common vision of the future with companies and other partners so as to collaboratively determine the best form for social systems and services. Specifically, it uses political, economic, social, and technological (PEST) analysis to identify external factors that will be present in the future and then determines the relationships these factors have with each other. Scenarios for changes in consumer values are then developed to identify “kizashi” (future signs) that provide valuable insights for making sense of the future.

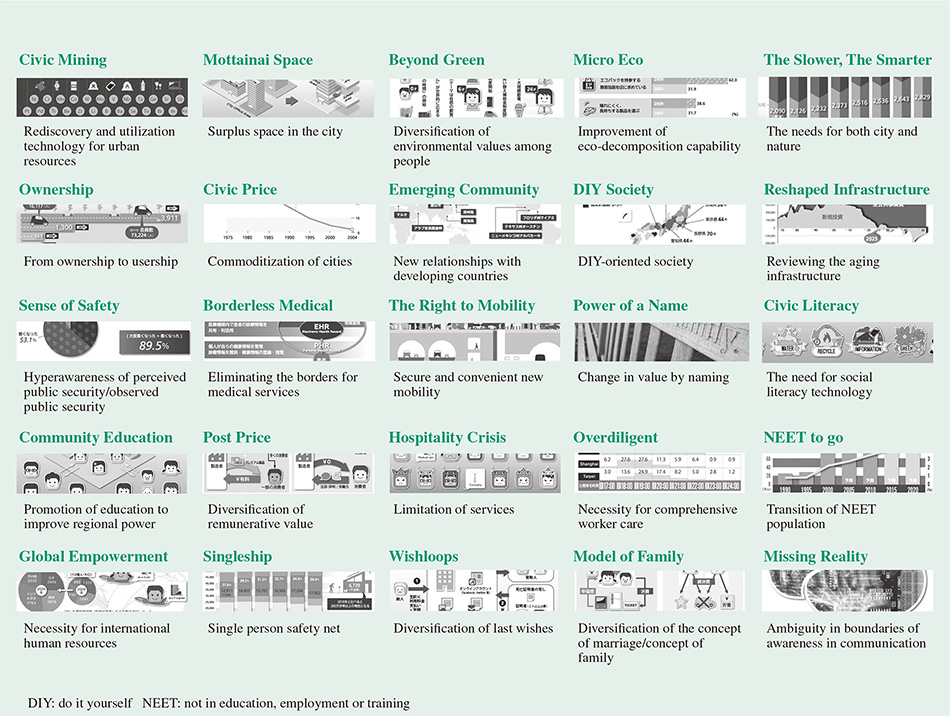

In 2011, Hitachi used the kizashi method to identify “25 Future Signs for 2025” that encapsulate changes in consumer values out to 2025, and published the results on the Internet (see Fig. 1).

Hitachi is currently using the kizashi method to promote the creation of future signs relating to finance. The objective is to obtain insights that will help in devising solutions for the future by determining how consumer behaviors will change over time in a finance industry where the border between finance and other industries is becoming increasingly blurred.

End user needs have been steadily evolving over recent years. Not only has the spread of the Internet and social media made consumer behavior more complex, it has also raised end user expectations for what services can provide. Likewise, the emergence of the millennial generation, a new type of end user with different outlooks and wants, has added impetus to the shift in power toward end users. In other words, the environment in which the finance industry operates is undergoing rapid changes that encompass end users as well as markets, regulations, and technologies. Accordingly, Hitachi believes it is possible to envisage a brighter future for finance by taking inspiration from future signs for the finance industry that point to changes in end user values.

Future signs for the finance industry include consideration of how developments in other industries influence the relationship between end users and money. The recent phenomena of the sharing economy and crowdfunding, for example, are giving rise to new relationships between people and money.

The sharing economy has expanded through the growth of a new layer of users who are prepared to share assets like vehicles or real estate, which people have previously found meaning in owning as personal property. Along with the economic benefits of this practice, these users also see value in being part of a sustainable society in which finite resources are shared, indicating that they will also choose to use money in ways that reflect this world view(3).

In the case of crowdfunding, it has been reported that people who share common ideals and values are prepared to pay more(4). This will lead to further increases in the number of end users looking for ways of using money that reflect their personal views. Such a future is likely to feature increasing demand for transparency in how the funds they invest are used, and expanding links between people who share the same ideals and values. This conclusion in turn provides insights into what sort of services can be provided in this future world, and what technological advances are required to do that.

Hitachi believes that these future signs for the finance industry can provide a source of inspiration for creating a more prosperous future while collaborating with a wide variety of stakeholders.

Fig. 1—25 Future Signs for 2025.

Hitachi captured the embryonic movements of change through insight into the future and came up with 25 signs of sustainable urban life.

Hitachi captured the embryonic movements of change through insight into the future and came up with 25 signs of sustainable urban life.

Fig. 2—Observation of the Consumer Behavior of Local Users.

Researchers clarify consumer behaviors while staying in the field and observing real consumption activities.

Researchers clarify consumer behaviors while staying in the field and observing real consumption activities.

One approach to developing concepts for financial solutions is to determine the attitudes and concerns that end users have with regard to how money is used, and then to use this as a basis for identifying latent needs so as to focus efforts on those concepts that are most feasible. In practice, Hitachi uses ethnographic research for this purpose, a technique in which researchers observe consumer behavior of local users based in the country or region concerned. Based on hypotheses developed in preliminary research, the researchers go out on the street to experience the retail stores and street vendors that the local people use daily. This involves inquiring into the attitudes and concerns that local users have about how money is used, while also having the researchers themselves visit the stores as customers to observe what payment methods are used.

For example, research of this nature that is conducted in emerging countries provides a sense of how consumer behaviors are different from those in developed countries. Such differences include people being reluctant to pay for products ordered from electronic commerce (EC) sites prior to receiving them due to a lack of confidence in the quality of both the products themselves and the delivery process; a preference for borrowing from family rather than financial institutions when purchasing high-value items; and that a consequence of low wages is that people spend money as they earn it rather than putting it in a bank account. By deepening the analysis to include aspects of the social context, such as the constraints and historical factors that give rise to consumer behaviors of local users, it is possible to investigate what service “touch points” and business models will best suit end users in the emerging countries (see Fig. 2).

Hitachi is also working to come up with solutions by considering needs and challenges from the perspective of financial institutions. Ethnographic research of the operations of such institutions, for example, involves researchers visiting insurance, banking, and securities offices (branches or agencies) and closely observing how they operate. This includes looking at coordination and decision-making practices that influence the quality of work as well as the actual sequence of tasks performed. By doing so, it is possible to consider the informal knowledge and skills that enhance the quality of work as well as the problems and requirements that staff face in the workplace.

Many operations at financial institutions involve work performed by people. The speed and quality of such operations will become increasingly important in the future because of their influence on things like customer retention and profitability. The uses for information acquired through ethnographic research in the workplace extend beyond improvements to existing business processes, also providing a resource for devising advanced business process models such as those that maximize staff capabilities by making use of innovative technologies in tasks that are performed by people.

Hitachi is also trialing techniques for developing innovative financial services through workshops with financial institutions. The workshops involve a detailed analysis and understanding of the management challenges and requirements of the financial institution, working together to come up with concepts for services that can overcome these challenges, and using business models to test the resulting concepts. Engaging in collaborative creation with financial institutions can accelerate the process of devising innovative technologies or ideas for services that can resolve a wider variety of societal challenges and expand business opportunities.

Fig. 3—Collaborative Creation Space for Customers at the Financial Innovation Laboratory in North America.

Hitachi established the Financial Innovation Laboratory in Silicon Valley to provide a venue for collaborative creation, meaning working with customers to achieve a common understanding of the challenges they face and to create new solutions.

Hitachi established the Financial Innovation Laboratory in Silicon Valley to provide a venue for collaborative creation, meaning working with customers to achieve a common understanding of the challenges they face and to create new solutions.

In April 2016, Hitachi established the Financial Innovation Laboratory at its Global Center for Social Innovation – North America, a research and development (R&D) center located near a football stadium and amusement park in the center of Silicon Valley (see Fig. 3).

In addition to existing research, which covers research into new financial services and business models supplied by financial technology (FinTech) companies, etc.; involvement in community activities that are increasingly open and standardized, such as the blockchain; and Hitachi's own innovations, the laboratory is also engaged in collaborative creation aimed at creating new value by bringing other organizations together, such as financial institution customers and FinTech companies with original ideas. It provides a research environment where the scenarios developed by this process can be implemented to verify how well they work.

The laboratory also intends to develop new ideas that extend beyond the borders of finance to allow staff from the other non-financial innovation laboratories that share the same site, such as those for the automotive and healthcare industries, the data scientists who support their work, and IoT researchers, to freely participate in this collaborative creation. It will facilitate, for example, the development of new financial products and financial services such as insurance for operations or asset-backed lending that make use of IoT technologies for predictive maintenance or fleet management, for which models already exist.

Furthermore, the laboratory hopes to create a new ecosystem for the development of financial solution concepts by setting up joint research with other research institutions, including Stanford University, the driving force behind Silicon Valley.

The finance industry is experiencing a period of rapid change driven by the changing structure of the market and new business models and innovations such as those of the FinTech companies. This change carries with it the potential to transform society by creating new relationships between people and money, and by giving rise to new values.

To prepare for this future, financial institutions are entering a period in which they will transform themselves. Hitachi intends to contribute to society by working with financial institutions to develop a vision for the future and to create innovative solution concepts for a new world.