The environment in which financial institutions operate is undergoing major changes due to finance industry entrants from other business categories and advances in IT, creating a need to re-evaluate the channels that serve as interfaces with customers. While, among those channels, there is a need for more effective specific reforms based around cost reductions in the branch channels of banks, such core measures as branch consolidation have been fully implemented already, and further moves in this direction, such as additional branch closures, will likely hurt customer service. In response, with regard to the strategic activities of banks, Hitachi is proposing to supply services that cover the work handled by individual branches. The proposed services would support four types of branch strategies with the aim of making banks more distinctive and improving their profitability. They would also rethink banking business processes with the aim of improving costs across the banking industry in the area of non-strategic activities through selective use of bundling and unbundling.

Planning Group, Financial Channel Solution Department 1, Financial Channel Solution Business Unit, Financial Channel Solutions & Payment Services Division, Financial Institutions Business Unit, Hitachi, Ltd. He is currently engaged in the planning of financial channel solutions.

Service Group, Financial Channel Solution Department 1, Financial Channel Solution Business Unit, Financial Channel Solutions & Payment Services Division, Financial Institutions Business Unit, Hitachi, Ltd. He is currently engaged in the planning of financial business.

IN the past, bank branches have been required to accurately process large numbers of requests for different types of administrative procedures that were brought to them by visiting customers. Given that situation, banks have reduced the volume of administrative procedures handled by branches and shifted the role of staff from administration to sales by expanding the use of channels such as automated teller machines (ATMs) and Internet banking that allow customers to complete the procedures themselves. Recently, there has been an emergence of services from players other than banks that duplicate some channel functions, such as ATMs at convenience stores and mobile payments, and also changes in the population distribution in Japan as a whole and at the regional level. These environmental changes are now seen as making it difficult for banks to retain sufficient contact with their customers. In order to respond to this situation, instead of the “branch facility” of the past, which delivers identical customer services at all branches, it will become important to provide facilities that can deploy branches rapidly in accordance with the aims (strategies) of each branch and the characteristics of the region.

This article describes what Hitachi is doing with regard to bank branch strategies in response to these challenges to the branch channel.

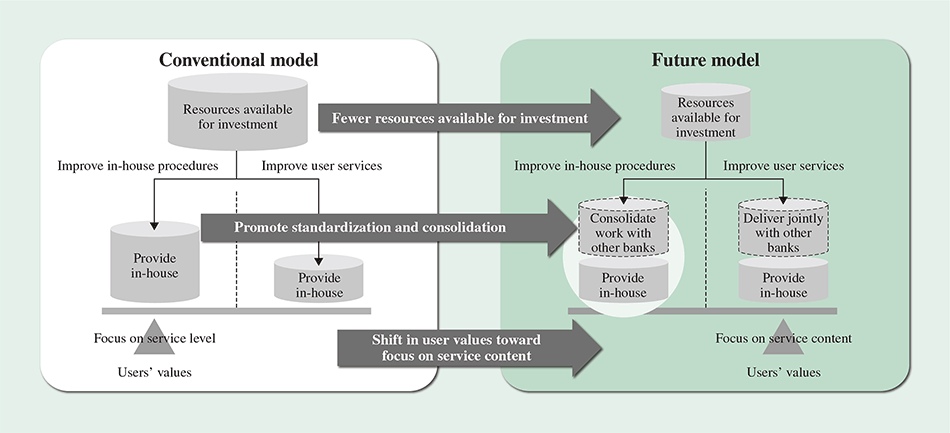

Japan's total population is predicted to fall below 100 million in 2048, with the working population also falling below 60 million (roughly 20% lower than in 2015). Also anticipated are a fall in demand for capital, especially from regional companies, and a lowering of the return on capital of regional financial institutions, in particular over the medium and long term, due to the negative interest rate environment. While finance remains a regulated industry in Japan that is still subject to numerous regulations under the supervision of the Financial Services Agency, the entry of new market players is anticipated due to factors such as financial technology (FinTech) and the May 2016 amendments to the Banking Act. With regard to technological advances, meanwhile, smartphones have proliferated rapidly sparked by the appearance of the iPhone* (with ownership of smartphones averaging about 83% among people in their 20's and 30's) and this is anticipated to change user values with respect to services. Given these circumstances, in order to maintain banking service levels, what are needed are operational efficiency improvements made through practices such as business process re-engineering (BPR) and business process outsourcing (BPO), which utilize information technology (IT), and the development of customer-oriented services in order to thrive amid more diverse and intense competition. Unfortunately, improvements to operational efficiency and usability for customers frequently turn out to be conflicting objectives. What is needed to solve this dilemma is a paradigm shift in resource investment. Along with directing resources toward strategic services while also keeping up with changes in user values, such as those associated with FinTech, it has also become necessary for banks to make further cost reductions by pushing ahead with the standardization of non-strategic, low-margin activities, such as administrative procedures, where there is little scope for differentiation from other banks, and on consolidating such work with other banks (see Fig. 1).

Fig. 1—Paradigm Shift in Bank Investment.

The paradigm shift in bank investment is toward delivering services that keep pace with changes in user values while remaining cognizant of competitors from other business categories in strategic areas. In non-strategic areas, meanwhile, this shift means pursuing further efficiency gains by getting rid of bank-specific procedures and standardizing and consolidating administrative procedures.

The paradigm shift in bank investment is toward delivering services that keep pace with changes in user values while remaining cognizant of competitors from other business categories in strategic areas. In non-strategic areas, meanwhile, this shift means pursuing further efficiency gains by getting rid of bank-specific procedures and standardizing and consolidating administrative procedures.

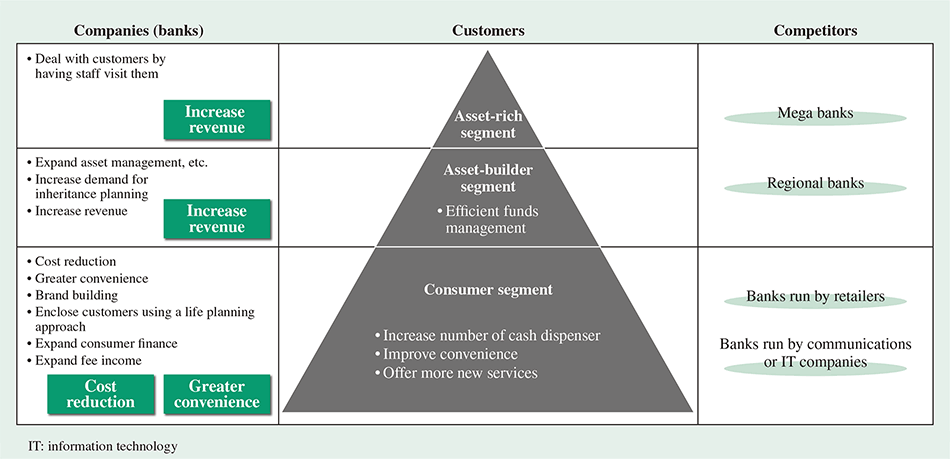

In considering future customer services, Hitachi considered channel strategies in terms of a 3C analysis of companies (banks), customers, and competitors, dividing bank customers into three segments, namely the asset-rich segment, the asset-builder segment, and the consumer segment (see Fig. 2). This section considers the consumer segment and the asset-builder segment.

The consumer segment contains those customers who are active consumers. The competitors in this context include retail-based banks and communications- and IT-based banks. A feature of these banks is that they deploy their own self-service channels that offer greater customer convenience, such as convenience store ATMs, and operate through business partnerships. The requirements for dealing with the consumer segment are to build up the brand while also installing more cash dispenser to improve customer convenience, and to improve profitability by expanding channels that provide access to consumer finance, a product that is in strong demand by people in this segment. Another requirement is to minimize investment costs as some aspects are difficult to differentiate from other banks.

The asset-builder segment refers to those customers who have a degree of savings that they are starting to increase gradually. Whereas people in this segment have a need for ways to invest their savings (portable assets) and to pass on property, the requirement for companies (banks) is to step up their sales with the aim of generating steady income from fund management fees. The competitors for the asset-builder segment are other banks (regional and mega banks), with a key point being the banks' use of their own product services and channels as a means of differentiation.

Fig. 2—Considerations Raised by 3C Analysis.

The asset-rich segment includes local people with high status or wealth. The asset-builder segment refers to those customers who have a degree of savings that they are starting to increase gradually. The consumer segment contains those customers who are active consumers.

The asset-rich segment includes local people with high status or wealth. The asset-builder segment refers to those customers who have a degree of savings that they are starting to increase gradually. The consumer segment contains those customers who are active consumers.

Next, because the branch channel is so dependent on regional characteristics, this section looks at the distribution of the population across different regions of Japan. Because this distribution is characterized by increasing polarization of the population between urban and suburban locations, it is necessary to consider urban and suburban branch designs separately. For example, regional polarization is becoming increasingly pronounced, and the urban populations of most regions are increasing while the populations in rural and other non-urban areas are steadily falling. Nevertheless, many rural locations have only ever had a single bank branch, meaning that further branch closures naturally pose a difficult problem for staff optimization.

Moreover, when considering the strategic opening of branches in locations such as new housing developments, deploying these branches with a sense of urgency is difficult in terms of cost as well as other factors when they require the same sort of heavy equipment as conventional branches, such as safes. Another difficulty with improving customer service might arise, for example, in the neighborhood of a railway station in an urban area when planning to open a new branch at the eastern exit of the station in response to a development project when there is already another branch at the western exit, in which case it is not possible to justify the cost of a conventional branch.

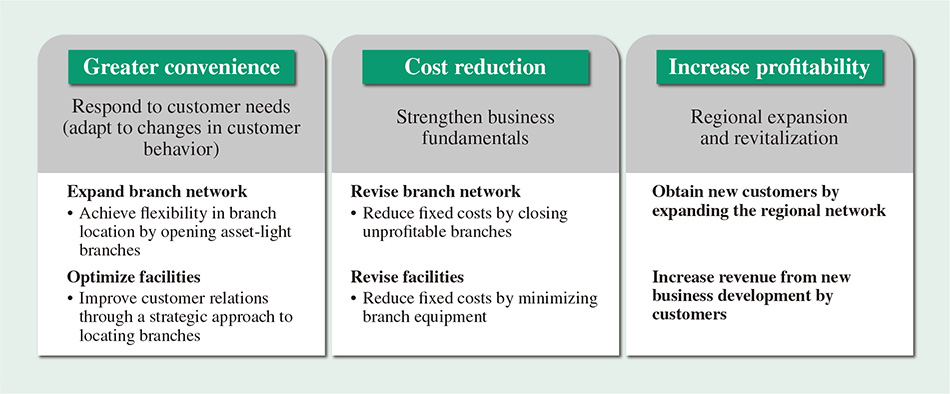

To deal with these challenges, Hitachi believes that new measures are needed that will improve customer convenience and cut costs by making changes to the bank branch network and branch facilities. Hitachi supports the branch strategies of banks through IT-based systems so that they can strengthen their business fundamentals and improve profitability while still maintaining ties to the community (see Fig. 3).

Fig. 3—Future Branch Strategies.

There is a need to proceed with measures such as increasing profitability by opening branches in places that suit the region, strengthening business fundamentals by cutting costs, and improving customer convenience by making changes to the branch network and branch facilities.

There is a need to proceed with measures such as increasing profitability by opening branches in places that suit the region, strengthening business fundamentals by cutting costs, and improving customer convenience by making changes to the branch network and branch facilities.

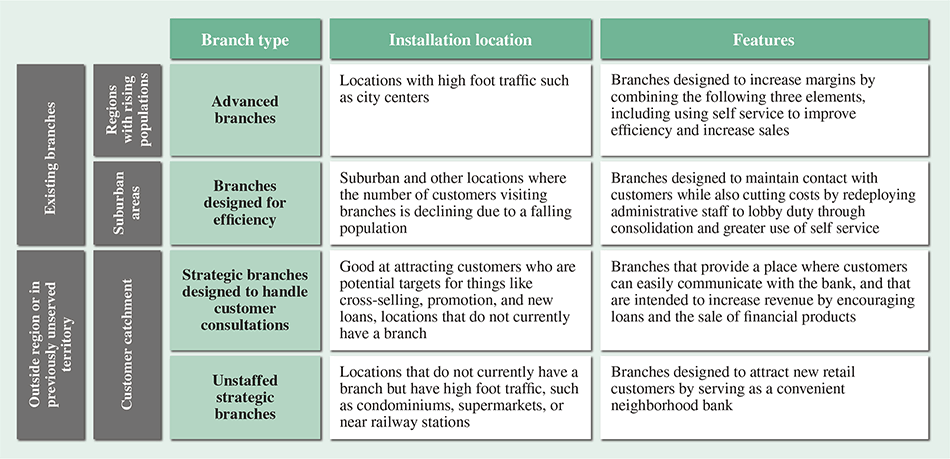

For future bank branches, Hitachi classifies the forms taken by bank branches into four main types with the aim of improving operational efficiency and speeding up branch deployment in accordance with the characteristics of the region and location. The four types are: unstaffed strategic branches, strategic branches designed to handle customer consultations, branches designed for efficiency, and advanced branches (see Fig. 4). The characteristics of each type of branch and the relevant solutions are described below.

Fig. 4—Four Types of Branch Strategies.

Branch strategies include turning existing branches into advanced branches in urban areas with rising populations and efficient branches in suburban areas with falling populations. They also include providing branches designed to handle customer consultations and unstaffed branches so that branches can be located in a strategic manner with the aim of acquiring customers from outside the region or in previously unserved territory.

Branch strategies include turning existing branches into advanced branches in urban areas with rising populations and efficient branches in suburban areas with falling populations. They also include providing branches designed to handle customer consultations and unstaffed branches so that branches can be located in a strategic manner with the aim of acquiring customers from outside the region or in previously unserved territory.

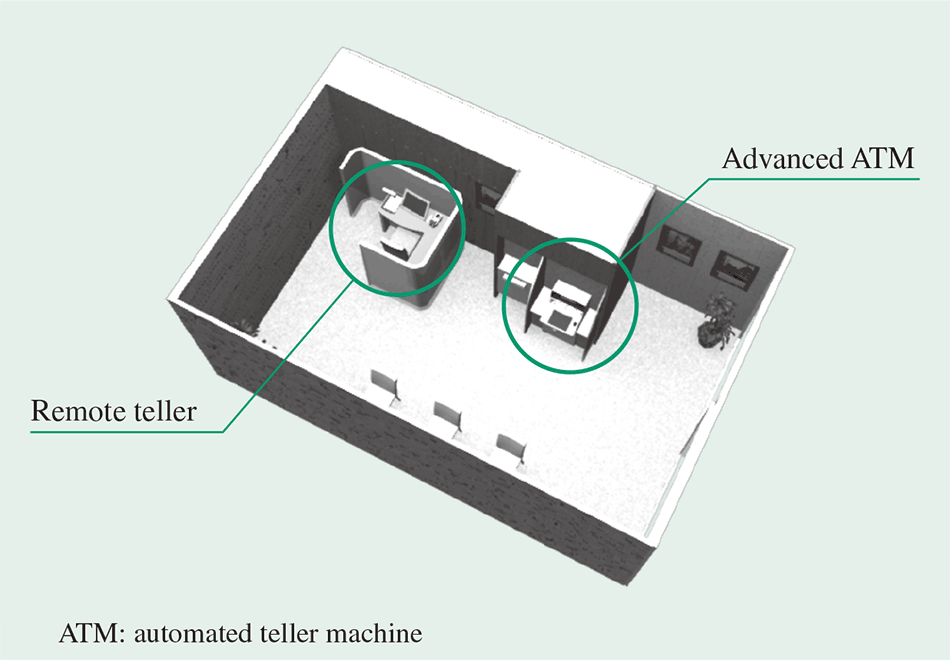

Fig. 5—Unstaffed Strategic Branches.

These branches are equipped with advanced ATMs that are fitted with a scanner or similar device to enable self service for transactions that require customers to bring documents with them, something that is a challenge for transactional services. They are also equipped with remote tellers that make it possible to operate a new type of “lightweight” bank branch in which transactions that involve account servicing and consulting with customers can be handled remotely.

These branches are equipped with advanced ATMs that are fitted with a scanner or similar device to enable self service for transactions that require customers to bring documents with them, something that is a challenge for transactional services. They are also equipped with remote tellers that make it possible to operate a new type of “lightweight” bank branch in which transactions that involve account servicing and consulting with customers can be handled remotely.

Unstaffed strategic branches are located in areas with high foot traffic, such as railway station buildings or condominiums, and are aimed at obtaining new retail customers by serving as convenient neighborhood banks. Because these branches are equipped with self-service devices such as advanced ATMs (ATMs that can be used to process form-filling procedures) and remote tellers (which can be used to undertake procedures or consult with staff located remotely via a video link), they can operate with minimal staffing (either no staff at all or just one person). In addition to deposits and withdrawals, which can be handled by the ATMs, these branches can also be used for taxes, public funds, private funds transfers, and official procedures or specialist consultations (see Fig. 5).

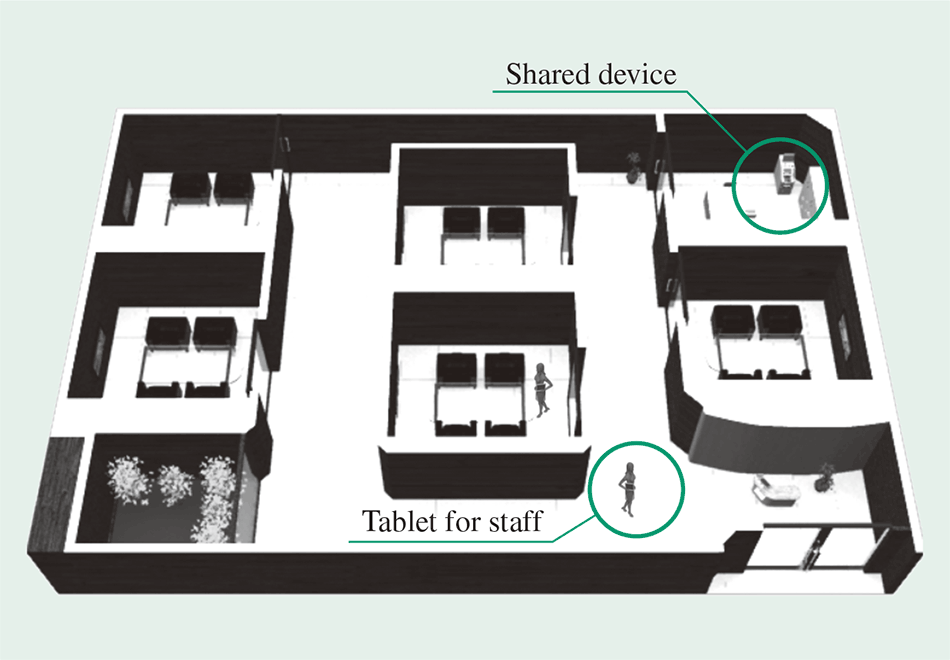

Fig. 6—Strategic Branches Designed to Handle Customer Consultations.

By using tablets loaded with Hitachi's branch system package, these branches use general-purpose devices in place of the terminal systems used in the past for branch accounting and enable staff to share the use of dedicated banking devices used for things like cash and bankbooks. This significantly reduces the cost of branch systems.

By using tablets loaded with Hitachi's branch system package, these branches use general-purpose devices in place of the terminal systems used in the past for branch accounting and enable staff to share the use of dedicated banking devices used for things like cash and bankbooks. This significantly reduces the cost of branch systems.

Strategic branches designed to handle customer consultations provide a place where customers can easily communicate with the bank and are aimed at promoting services such as lending and the sale of financial products. Because these branches are designed for consultations, they do not make much use of cashiers or banking devices such as bankbook printers. Accordingly, a small number of such devices can be shared by the entire branch and operated from the tablets used by the staff. This minimizes the quantity of special-purpose equipment that needs to be supplied to a new branch and allows a customer-oriented layout to be adopted without having to worry about where these devices are installed. This enables the low-cost, strategic deployment of branches that are primarily intended for dealing with customers (see Fig. 6).

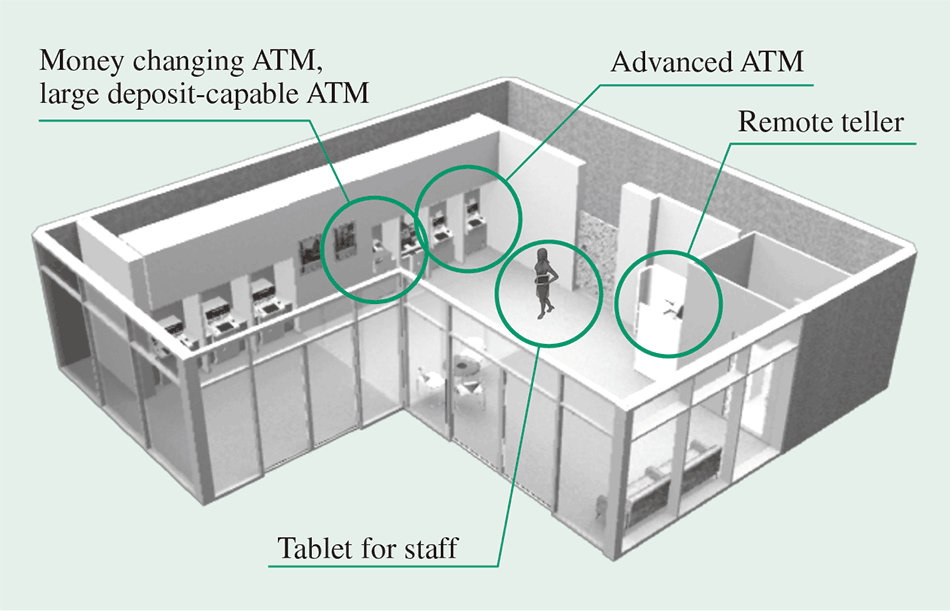

Fig. 7—Branches Designed for Efficiency.

This branch format ensures a certain number of lobby staff despite aggressively reducing the number of administrative staff through the use of self service. It is intended to significantly reduce staff administrative workloads by having customers undertake such procedures for themselves, while maintaining contact with customers by having lobby staff greet them.

This branch format ensures a certain number of lobby staff despite aggressively reducing the number of administrative staff through the use of self service. It is intended to significantly reduce staff administrative workloads by having customers undertake such procedures for themselves, while maintaining contact with customers by having lobby staff greet them.

A feature of branches that are designed for efficiency is that they enable a certain number of lobby staff to be retained while aggressively reducing the number of administrative staff through the use of self service. The aim is to reduce staff administrative workloads by having customers undertake such procedures for themselves, while maintaining contact with customers by having lobby staff greet them. Because the tablets used by the lobby staff in these branches have access to information provided by customers when undertaking procedures on self-service devices and their progress, the staff can monitor how each customer is getting along. This function makes it possible for staff to provide assistance or advice when appropriate, improving administrative efficiency, while still maintaining communication with customers (see Fig. 7).

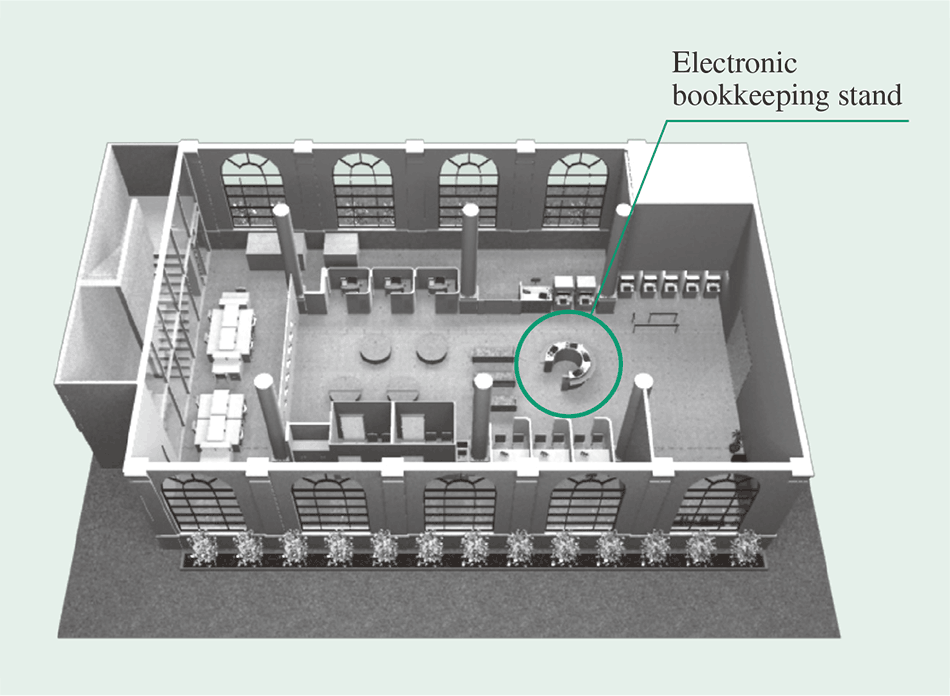

Fig. 8—Advanced Branches.

Electronic bookkeeping stands aim to improve operational efficiency further and to strengthen interaction with customers by converting conventional forms into electronic forms and by putting data entry devices online (for data sharing between branch system and accounting system).

Electronic bookkeeping stands aim to improve operational efficiency further and to strengthen interaction with customers by converting conventional forms into electronic forms and by putting data entry devices online (for data sharing between branch system and accounting system).

Advanced branches combine all of the elements described above, including those for efficiency and sales improvement. A feature of these branches is that they are located in urban areas and have high foot traffic. They provide improvements in both efficiency and sales by having reception determine the requirements and aims of each customer's visit and then directing them to the appropriate service, making use of the information on the current status of the branch's staff and service channels. Administrative procedures can be performed on self-service devices, freeing staff to use their tablets for sales work in the lobby or the consultation rooms (see Fig. 8).

Up to this point, the strategies for each of the four types of branch have been described. This section describes the solutions to be applied for each branch. Hitachi supplies customer-operated self-service solutions, such as electronic bookkeeping stands that facilitate appropriate pre-assessments of customers when they arrive at the branch by having them electronically input the requirements for their visit, remote tellers that can be used to complete procedures using a video link when needed with assistance from remotely located staff who are provided to handle specialist consultations or to undertake procedures outside of normal working hours, and advanced ATMs that can be used for form-filling procedures as well as normal ATM functions. By supplying these self-service solutions, Hitachi aims to improve customer convenience by making them available for afterhours use, for example. By equipping staff with devices that allow mobility, such as tablets for staff, the flow of customers in the branch can be reformed to achieve a style of customer service where staff go out among the customers. The cost of devices is reduced by sharing banking devices between multiple staff. Cost reduction can be achieved without compromising service levels by applying a combination of these solutions that suits the characteristics of the branch (see Fig. 9).

Fig. 9—Operations and Solutions for Each Type of Branch.

The establishment of new types of branches represents a shift toward greater operational efficiency and stronger sales by promoting overall optimization, including the lobby and back office, as well as by reducing teller window and middle office work.

The establishment of new types of branches represents a shift toward greater operational efficiency and stronger sales by promoting overall optimization, including the lobby and back office, as well as by reducing teller window and middle office work.

Service delivery at bank branches demands a rapid response to customers' increasingly diverse needs together with more efficient operation of the associated systems. To shift personnel toward strategic activities while still maintaining and improving branch efficiency, it is necessary to break down business processes into individual functions, to modularize the IT for each function, and to develop practices that can make effective use of this IT. The implementation of these various modules also requires measures that are resilient to change, such as ways of strengthening crisis management, overall service capabilities, and governance, and the efficiency of bank operations can be improved even further by designing the modules to have a higher degree of reusability. Hitachi believes that modularizing banking services in an appropriate manner will facilitate things like the outsourcing of procedures that are handled at the level of individual modules or the consolidation of such work with other banks, and can develop into efficiency improvements that have even greater flexibility.

Currently, progress is being made on outsourcing at the level of bank branches and elsewhere by spinning off particular operations. However, many of these spun-off operations include requirements that are specific to the bank concerned and it is feared that this will pose an obstacle to future initiatives such as the consolidation of such operations with other banks. In order to make further cost reductions and operational improvements, an important feature of BPO in the future will be that, rather than each bank offering its own individualized services, these services will be modularized as standard business processes so that the resulting modularized processes can be shared among banks. This modularization will require processes to be divided in order to permit the rapid introduction of new services and changes to practices. The applications in Hitachi's branch system packages were designed and developed in component form to facilitate this division and reconstruction, enabling implementation in the form of components and modules at a functional level. However, BPO requires not only the division and reconstruction of applications at the system level, but also the sharing and reallocation of human resources for performing administrative procedures. To solve this problem, Hitachi has started to supply a remote teller solution that provides support for such procedures from an off-site location.

The remote teller solution provides a way for tellers with specialist skills who are based off-site to accurately perform administrative procedures for customers. If this business process, too, can be suitably divided and reconstructed, it will be possible for different banks to consolidate the work in a way that lets them share resources (see Fig. 10).

Fig. 10—Modularization of Operations for BPO.

Modularizing and consolidating standard business processes makes outsourcing easier and enables further cost reductions.

Modularizing and consolidating standard business processes makes outsourcing easier and enables further cost reductions.

A new way of using branches that arises when changing the format of branches to suit the region (location) and aims of the branch, as described above, is for multiple financial institutions to operate branches jointly. An example of this that is already in operation is where multiple financial institutions provide after-sales services using a BPO model based on jointly operated branches, such as handling changes of address or reissuing cash cards for the private customers of regional banks who have moved away from their region to live in a city. It is anticipated that this approach will be adopted more widely in the future as a way of improving customer convenience in locations that have high foot traffic, such as near railway stations or in shopping malls, particularly in cities.

In rural areas, meanwhile, improving the efficiency of aging and unprofitable branches is a pressing concern for regional financial institutions, meaning there is potential for such rural branches to adopt a BPO model based on joint operation that can consolidate non-strategic after-sales services within a region by outsourcing this work to other regional financial institutions or agencies such as post offices that operate nationwide branch networks. Because mobile branches are not economically feasible in those rural areas that are even more sparsely populated, there is scope for having these operated by multiple financial institutions, or for services based on a joint BPO model involving cooperation with companies from other business categories, such as logistics. It is anticipated that BPO models like these that cross multiple industries and work through joint participation by multiple financial institutions or companies from other business categories will be adopted as a way for financial institutions to maintain service continuity. Hitachi believes that its solutions that facilitate the modularization of business processes and their division and reconstruction are suitable for implementing these BPO models in which operations are shared by multiple financial institutions.

This article has described the forms that Hitachi expects bank branches will take in the future and the measures for achieving these forms based on the challenges facing the branch channels operated by banks. It is anticipated that things like linking with new smartphone-based services and using ATMs as cash dispenser will play a more important role in the future as changes are made to the format of branches to suit their regions and aims. With a product range that encompasses channel services as well as the devices presented in this article, Hitachi is able to serve as a one-stop supplier of channel solutions. Hitachi can also supply services with high added value by combining these solutions with customer relationship management (CRM) information systems that incorporate new technologies such as robots, artificial intelligence (AI), and big data analytics. By sharing a vision for branches (channels) with its customers, Hitachi intends to develop new branch solutions.