GLOBAL INNOVATION REPORT

Manufacturing Power Strategy on Show in “Made in China 2025”

Industrial competition in the world is currently entering a critical phase. Amid these developments and in response to a historic opportunity for next-generation industrial innovations in Chinese manufacturing, China has published its Made in China 2025 strategic plan. This article presents an overview of that plan.

Industrial competition in the world is currently entering a critical phase. The even closer fusion of next-generation information technology and manufacturing is driving highly influential industrial innovations and shaping a steady stream of new production practices, industry structures, business models, and economic growth sectors. Along with all this, attention is also being drawn to the new technological innovations of Industrie 4.0 and the Industrial Internet being led by Europe and America.

Amid these developments and in response to a historic opportunity for next-generation industrial innovations in Chinese manufacturing, from 2013 the Chinese government embarked on “Manufacturing Power Strategy Research” aimed at bringing about a shift in manufacturing away from mass production toward higher levels of quality and efficiency, publishing its Made in China 2025 strategic plan in May 2015. This article presents an overview of that plan.

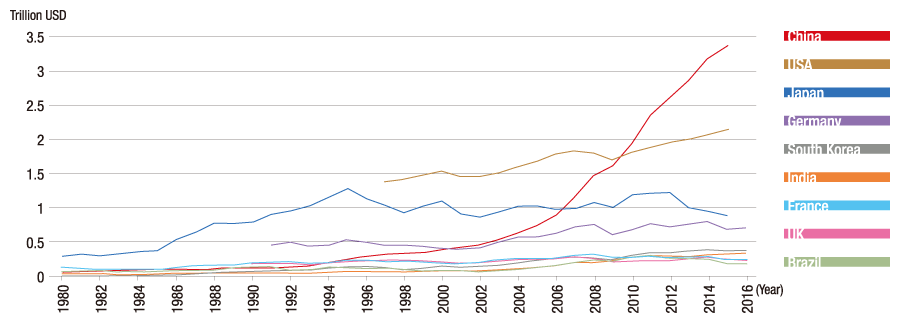

The sustained growth of Chinese manufacturing since the economic reforms of 1980 have led to the formation of distinctive industrial structures in a variety of sectors and significant progress toward industrialization and modernization. According to data from the World Bank, value added by Chinese manufacturing reached $US2.62 trillion in 2012 after several decades of rapid growth, overtaking the USA to become the world’s largest manufacturer (see Figure 1). However, while China has become a major manufacturing nation through volume expansion, it cannot yet be described as a “manufacturing power,” falling significantly behind developed nations in terms of factors such as indigenous innovation, resource use efficiency, industrial structure, level of information technology (IT), quality, and productivity. Therefore, it is under pressure to transform its production practices.

Figure 1Comparison of Value Added by Manufacturing in Major Countries Prepared based on World Bank “Manufacturing, value added” data. The 2014 and 2015 fi gures for China were collated by the author based on data published by the National Bureau of Statistics of China.

Prepared based on World Bank “Manufacturing, value added” data. The 2014 and 2015 fi gures for China were collated by the author based on data published by the National Bureau of Statistics of China.

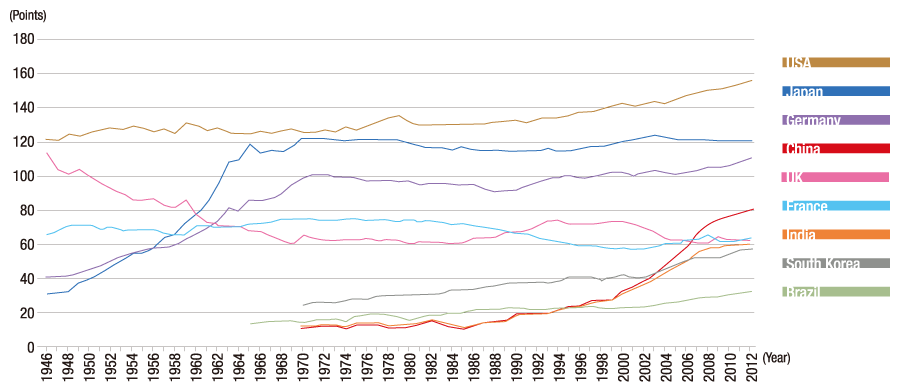

Chinese manufacturing is also facing challenges on two fronts, with developing nations catching up while developed nations are re-industrializing and adopting advanced manufacturing practices. In response to this situation, China’s State Council and Ministry of Industry and Information Technology engaged the Chinese Academy of Engineering to embark on a major inquiry entitled “Manufacturing Power Strategy Research” in January 2013. This involved a study into the role and strategic vision of Chinese manufacturing conducted over two years by 150 experts, engineers, and researchers. The study established its own set of indices for assessing the world’s major manufacturing nations. Based on these, the overall index of manufacturing in major nations as of 2012 placed the USA in first place (160 points), followed by Japan (120 points), and then Germany (115 points), with China in fourth place (80 points) (see Figure 2).

As the industrialization of China is still in progress, this industrialization is taking place simultaneously with the adoption of IT. This is a significant difference from the path followed by the advanced industrialized nations (USA, Japan, and Germany) where the adoption of IT came after industrialization. Compared to those advanced industrialized nations, China is still in the middle and late period of industrialization, with the expectation that this process will be completed by around 2025 to 2030.

Figure 2Overall Index of Manufacturing in Major Nations from 1946 to 2012 The overall index was calculated based on the index criteria devised for the manufacturing assessment system of the “Manufacturing Power Strategy Research” working group of the Chinese Academy of Engineering (a primary index made up of four criteria and a secondary index made up of 18 criteria).

The overall index was calculated based on the index criteria devised for the manufacturing assessment system of the “Manufacturing Power Strategy Research” working group of the Chinese Academy of Engineering (a primary index made up of four criteria and a secondary index made up of 18 criteria).

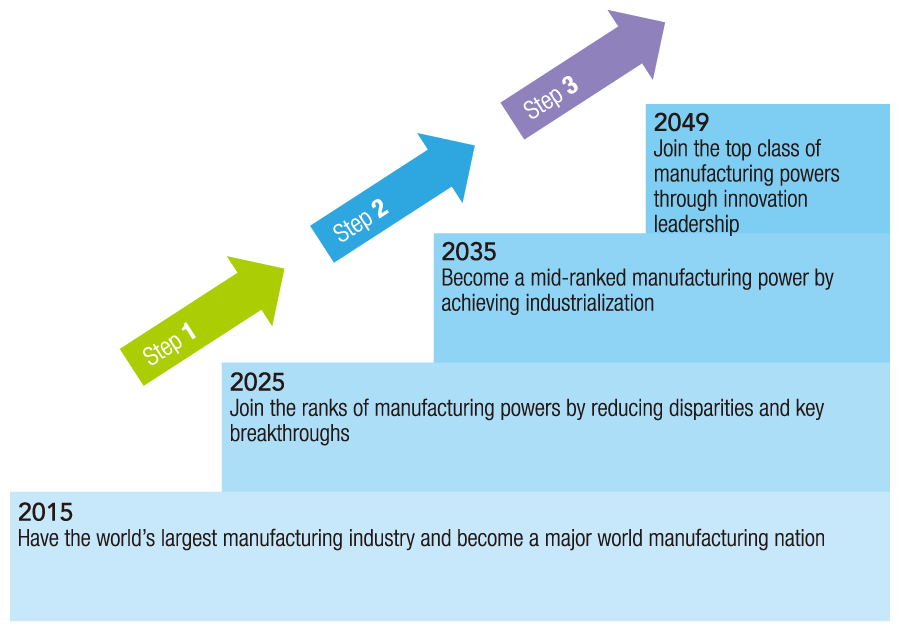

Figure 3Three-step Strategy of Made in China 2025 Prepared by author based on material regarding Made in China 2025 published on May 19, 2015 on the web site of China’s Ministry of Industry and Information Technology

Prepared by author based on material regarding Made in China 2025 published on May 19, 2015 on the web site of China’s Ministry of Industry and Information Technology

Based on the results of the Manufacturing Power Strategy Research project, the Chinese Ministry of Industry and Information Technology worked from 2014 with 20 government agencies, including the National Development and Reform Commission, the Ministry of Science and Technology, Ministry of Finance, and Chinese Academy of Engineering, to formulate a long-term strategic plan for developing the manufacturing industry that was formally published by the State Council as “Made in China 2025” on May 19, 2015.

Based on the current progress of China, Made in China 2025 seeks to achieve its strategic target of becoming a manufacturing power in three steps (see Figure 3). Step 1 is to join the ranks of manufacturing powers by 2025, and step 2 is to become a mid-ranked manufacturing power by 2035. Step 3 is to join the group of leading manufacturing powers by 2049, the 100th anniversary of the founding of the People’s Republic of China.

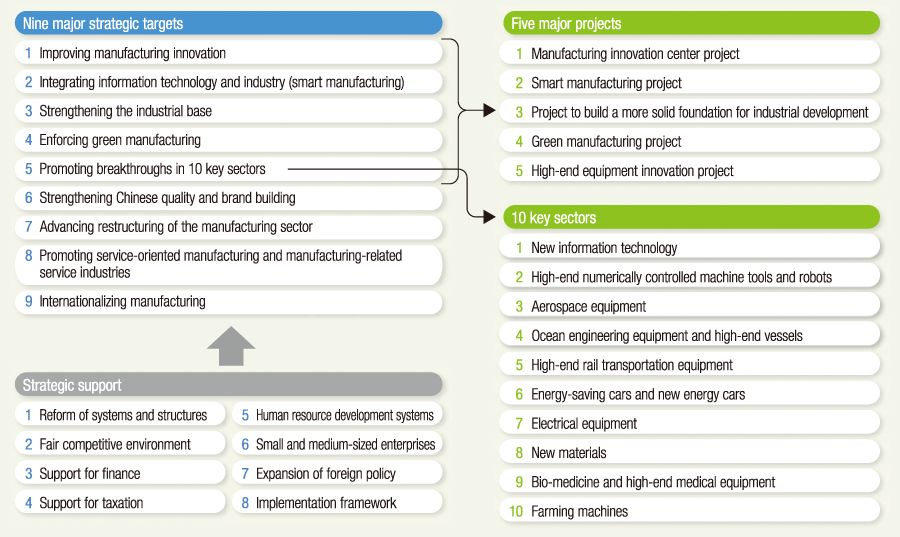

To achieve this strategic objective, Made in China 2025 enumerates nine major strategic targets, listed in Figure 4, together with five major projects and 10 key sectors. It also notes that, of the nine major strategic targets, the second target of integrating information technology and industry plays a central role, and that smart manufacturing will be central to putting the plan into action. The 10 key sectors are split into four groups, namely new information technology (one sector), high-end equipment (seven sectors), new materials (one sector), and biological medicine and medical devices (one sector), with the high-end equipment sector considered to be crucial to the national economy and defense.

To ensure consistent coordination of work on becoming a manufacturing power, the State Council established a supervisory group for this purpose in June 2015. The group took up overall management of all aspects of work on becoming a manufacturing power, with State Council supervisors serving as representatives, and the group membership being drawn from 23 departments or committees that report directly to the State Council. The supervisory group is administered from within the Ministry of Industry and Information Technology, which is responsible for its day-to-day activities. The National Manufacturing Strategy Advisory Committee was established in August 2015 to serve as a think tank by conducting studies and submitting opinions and proposals on the outlook for manufacturing industry development and major problems and policies associated with the strategy. The committee also assists with the establishment of multiple layers of think tanks, including private and corporate think tanks, and provides strong support from a knowledge perspective for becoming a manufacturing power.

Figure 4Made in China 2025 Strategic Targets and Priority Projects Prepared by author based on material regarding Made in China 2025 published on May 19, 2015 on the web site of China’s Ministry of Industry and Information Technology

Prepared by author based on material regarding Made in China 2025 published on May 19, 2015 on the web site of China’s Ministry of Industry and Information Technology

Much has been achieved based on the Made in China 2025 plan over the two years since 2015, including the start of the plan’s top-level design, major projects, regional and corporate models, and “Internet Plus.”

The “1+X” plan refers to the combination of the Made in China 2025 plan with a number of sub-plans for specific sectors and industries. Since Made in China 2025 was published, 11 of these sub-plans have been formulated, primarily involving the Chinese Ministry of Industry and Information Technology. These include implementation guidelines for the five major projects and action plans or guidelines for six areas, namely service-oriented manufacturing, improving the quality and brands of Chinese equipment manufacturers, developing the medical industry, IT industry, new materials, and human resource development for manufacturing. Technology roadmaps were also published for the 10 key sectors. The 10 sectors were broken down into 23 representative products and technologies, looking forward to 2030 by analyzing conditions up until 2025 based on the five criteria of market forecasting, targets, training priorities, model applications, and support policies. Moreover, implementation guidelines and action plans relating to Made in China 2025 were approved at the level of 29 provinces, cities, and regions.

A document published by the State Council in 2016 about directives and opinions relating to deepening the mutual development of manufacturing and the Internet was formulated and became a driver for expediting the work on becoming a manufacturing power by having both Made in China 2025 and Internet Plus proceed in tandem.

Made in China 2025 includes pushing forward aggressively on the five major projects, with activities from corporate model cases to city model tests being rolled out nationwide.

The National Power Battery Innovation Center, China’s first national manufacturing innovation center was established in Beijing on June 30, 2016, with the National Additive Manufacturing and New Material Innovation Center in Xi’an following in 2017. Current plans include the establishment of innovation centers for robots and electronic information. These plans will see national innovation centers established at 15 different locations by 2020. Approval has also been granted for the establishment of provincial-level innovation centers at 19 locations. A total of 61 projects focusing on 47 different directions associated with strengthening fundamental technologies are underway, with a total investment reaching 10.8 billion yuan.

For the smart manufacturing at the core of the five major projects, the central government invested 34.3 billion yuan, conducted 226 projects involving demonstration projects or model applications for the standardization of smart manufacturing, and formulated national smart manufacturing standard systems implementation guides to overcome the problem of siloed information systems. As shown in Figure 5, 109 companies were selected as model cases between 2015 and 2016, with a further 98 selected in 2017. The results for the 109 model case companies were increases of 32.9% in production efficiency and 11.3% in energy efficiency, a 19.3% reduction in operating costs, 30.8% shorter research and development (R&D) times, and a 26.3% reduction in the proportion of defective products.

Work on smart manufacturing moved on from the model case company stage to the model city stage in the latter half of 2016, starting with model city designations for 12 cities and four groups of cities. The selection of model cities was split between the eastern, central, western, and northeastern regions of China and covered cities with different development models, namely older industrial centers, innovation-driven cities, and resource-driven cities, with the model cities demonstrating the benefits of regional leadership. The results indicated the increasingly rapid formation of the “new tripolar” situation whereby the regional distribution of manufacturing comprises a re-orientation toward the production of high-end equipment in the east, an upgrading of the level of industry in the center, and innovation in the west in industries where it has a competitive advantage.

To support these model tests, the central government provided 20 billion yuan in funding and the cities each contributed several billion yuan annually of additional funds. The government of Ningbo, for example, set aside a budget of 10 billion yuan over three years, with up to 50 million or 30 million yuan in matching funds being contributed for industrial investments (100 million yuan or more) by companies or for investments (10 million yuan or more) in upgrading technology.

The 2017 Oriented Plan on Technology Reforming and Upgrading of Industrial Enterprises was published in September 2017 and contained plans for 644 projects across eight sectors and 13 industries, including projects for smart manufacturing, green manufacturing, and quality improvement, with an anticipated total investment of 400 billion yuan and loans of 160 billion yuan.

Figure 5Map of where Smart Manufacturing Model Cases are being Promoted for Made in China 2025 (as of September 2017)  Prepared by author based on the data published by the National Bureau of Statistics of China’s Ministry of Industry and Information Technology in the Made in China 2025 Blue Book (2017 edition). The number next to each province indicates its national ranking for total sales by industrial companies in 2015 in the province or direct-controlled municipality.

Prepared by author based on the data published by the National Bureau of Statistics of China’s Ministry of Industry and Information Technology in the Made in China 2025 Blue Book (2017 edition). The number next to each province indicates its national ranking for total sales by industrial companies in 2015 in the province or direct-controlled municipality.

To strengthen green manufacturing, support was provided for fostering 251 branded companies by strengthening quality and brand building, with the selection of 99 companies for green design model tests, 51 low-carbon industrial sites, and 201 companies for green factory model cases.

Figure 6Overall Level of Smart Manufacturing in China  Prepared by author based on the 2016 Report on Made-in-China Informatization Index-MCII published in November 2016 by China Info 100.

Prepared by author based on the 2016 Report on Made-in-China Informatization Index-MCII published in November 2016 by China Info 100.

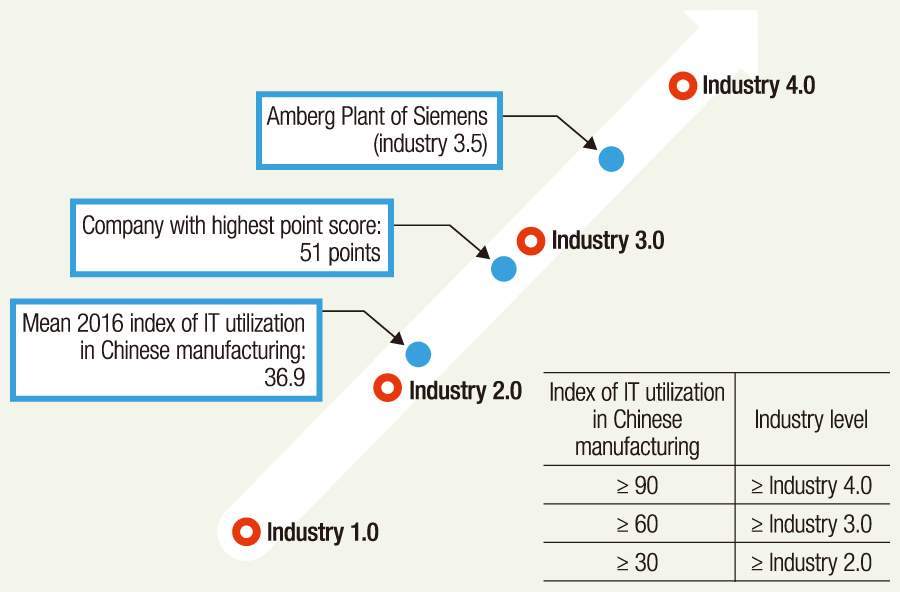

Chinese manufacturing covers 30 areas, with approximately 300,000 Chinese manufacturing companies having an annual operating revenue of 20 million yuan or more. There is significant variation in the levels of development of the different sectors and companies, with a mix of different stages of industrialization. Overall, industry 1.0 (mechanization) is complete, industry 2.0 (industrial automation) is a work in progress, and industry 3.0 (adoption of IT) is an aspiration. To achieve smart manufacturing, it will be necessary to advance industry 2.0, 3.0, and 4.0 simultaneously, following a process of multiple-development-style systems.

The Made-in-China Informatization Index-MCII (in which indices were calculated using a 29-index system based on data for approximately 70,000 manufacturing companies by the China Service Platform for Integration of Informationization and Industrialization) found that the average value of the index for the adoption of IT by Chinese manufacturers was 36.9, a 3.8% increase over 2015, and that manufacturing overall is progressing from industry 2.0 to industry 3.0 (see Figure 6). There is a mix of different levels from industry 1.0 to 3.0, with the highest scoring companies having reached the industry 2.7 stage while the worst performing are still at industry 1.0 (mechanization).

The survey’s findings for the extent of penetration of IT into Chinese manufacturing were that the percentage of production equipment with numerical control was 44.1% and that, in the case of core industrial software, adoption of manufacturing execution systems (MESs) was at 23.3%. The percentage using a corporate platform for business network collaboration was 11.8% (see Figure 7).

Figure 7Penetration of IT into Chinese Manufacturing in 2016  ERP: enterprise resource planning

ERP: enterprise resource planning

PDM: product data management

PLM: product life-cycle management

SCM: supply chain management

CRM: customer relationship management

MES: manufacturing execution system

Prepared by author based on the 2016 Report on Made-in-China Informatization Index-MCII published in November 2016 by China Info 100.

The author visited 10 Chinese manufacturers between September 2015 to March 2016 to question them about their levels of automation and IT. The group comprised two vehicle manufacturers (with annual sales of 10 billion yuan or more), one semiconductor manufacturer (with annual sales of 1.5 billion yuan), three pharmaceutical manufacturers (with annual sales of one billion yuan), and three food manufacturers (with annual sales of 100 to 300 million yuan). The levels of automation and IT at the companies questioned were found to be as shown in Figure 6. Whereas a major vehicle manufacturer had already started formulating a smart manufacturing strategy at the time of the visit, the small and medium-sized enterprises were cautious about investing in smart technologies and were keeping an eye on the activities of large companies, although they had made a start on automation.

Moreover, the companies surveyed (especially those with annual revenues of more than one billion yuan) were able to express a variety of needs. The following are some typical examples.

While Germany’s Industrie 4.0 has had the greatest influence on smart manufacturing in China, it is anticipated that Made in China 2025 will also draw heavily on Japan’s experience with making industry more advanced and its tradition of technology and expertise.

Based on the state of manufacturing in China, current conditions in China provide Hitachi with the following opportunities.

As the world is goes through another industrial transformation, Made in China 2025 aims to close the gap in manufacturing with developed nations and to catch up with the fourth industrial revolution being championed by Europe and America. China is currently at the stage of establishing a huge market of 1.3 billion consumers while also moving ahead simultaneously on industrialization, the adoption of IT, urbanization, and agriculture modernization, with urbanization and agriculture modernization providing a large market and placing a high level of demand on the development of the manufacturing industry. This article has focused on the background, major points, new developments, characteristics, and business opportunities associated with the Made in China 2025 strategy in order to come to grips with major changes in strategy for Chinese manufacturing.

Li Keqiang, Premier of China’s State Council, had the following message for the World Economic Forum in Davos in June 2017.

“There is a misunderstanding that the purpose of Made in China 2025 is to avoid buying foreign equipment, but this is impossible. Amid globalization, to close our doors and build up the quality and standard of our own machinery would equate to pursuing a course ignoring objective reality. China is forming cooperative arrangements with countries like Germany and the USA and we expect to see more foreign capital equipment and technology entering the Chinese market.”

Hitachi has the opportunity to draw on its strengths in operational technology (OT), IT, and manufacturing to advance in tandem with Chinese companies in the smart manufacturing sector by working with them toward Made in China 2025 on a win-win basis.