1. Use of CMOS Annealing for Portfolio Optimization

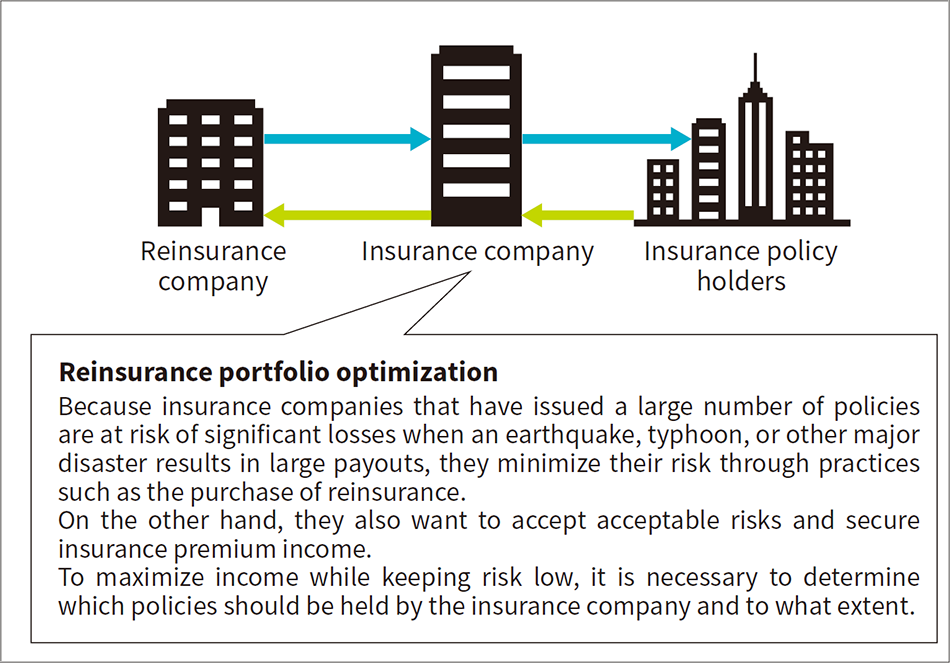

Hitachi has been working with Sompo Japan Insurance Inc. on a collaborative creation project aimed at reinsurance portfolio optimization. Whereas the computation time constraints of existing technology have restricted such applications to geographically limited partial optimization, more comprehensive optimization covering a wider geographical region has the potential to deliver significant benefits.

A demonstration project has been underway since January 2019 aimed at overcoming these constraints through the use of Hitachi’s proprietary technology for solving large optimization problems at high speed by means of complementary metal-oxide semiconductor (CMOS) annealing.

The customer’s choice of Hitachi as a collaborative creation partner was prompted by the technological superiority of its solution at handling large problems compared to that of similar technologies from other companies (specifically, its ability to work with a world-leading number of spins*) and its approach of having its engineers study the customer’s business practices. The demonstration project demonstrated the technology’s potential for use in decision-making by the customer, achieving a more than 100-fold performance improvement over their conventional method. This means that computations can be completed in less than a week that would have taken around three years using existing technology.

The project also provided preparation time for the two companies, with the work set to continue based on plans for installation during FY2021. Hitachi also launched a workshift optimization service in October 2019 that utilizes the same technology.

- *

- As of October 2020, based on research by Hitachi, Ltd.