Latest Digital Solutions and Their Underlying Technologies

The use of medical big data and the latest analytics techniques to enhance a diverse variety of insurance services has become a field of considerable activity. With expertise in the analysis of clinical and medical claims data that is drawn from its many years of experience in supporting the operations of health insurance organizations, Hitachi is collaborating with The Dai-ichi Life Insurance Company, Limited on the development of risk analysis techniques for life insurance companies. The hospitalization risk prediction model developed as part of this joint research has increased the number of new policy holders through its use in optimizing Dai-ichi Life’s insurance acceptance criteria. Hitachi is also planning to utilize the know-how acquired from this joint research to establish a hospitalization risk simulation service for insurance companies.

Financial Information Systems Business Unit 4, Financial Information Systems 2nd Division, Hitachi, Ltd. Current work and research: Development of new businesses in collaboration with an insurance company.

Financial Information Systems Business Unit 4, Financial Information Systems 2nd Division, Hitachi, Ltd. Current work and research: Development of new businesses in collaboration with an insurance company.

Medical Systems Research Department, Center for Technology Innovation – Healthcare, Research & Development Group, Hitachi, Ltd. Current work and research: Research and development of healthcare information systems. Society memberships: The Institute of Electronics, Information and Communication Engineers (IEICE), the Japan Association of Diabetes Informatics (JADI), and IEEE.

Medical Systems Research Department, Center for Technology Innovation – Healthcare, Research & Development Group, Hitachi, Ltd. Current work and research: Research on healthcare data analytics.

Hitachi has built up expertise in the analysis of clinical outcomes and data from medical claims for medical services through its long experience in helping health insurance organizations improve their operations. Examples of this include the disease progression and healthcare cost prediction models announced in 2014(1), (2).

In the health insurance industry, meanwhile, interest is growing rapidly in innovation achieved through the combination of insurance and technology (often referred to as “InsurTech”). Insurance companies are vigorously pursuing such initiatives, including by actively embarking on collaborations with partners from outside their industry.

This article describes the creation of a risk simulation service for the insurance market that draws on expertise in the analysis of clinical, medical claims, and other medical big data, and also examples of collaborative creation with The Dai-ichi Life Insurance Company, Limited (Dai-ichi Life).

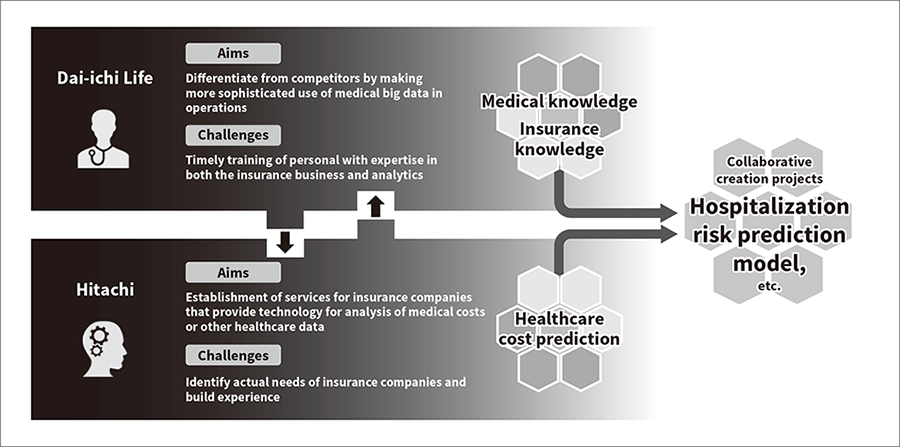

This section describes Hitachi’s joint research with Dai-ichi Life and the outcomes of this work. Dai-ichi Life has proven itself to be an industry leader in the application of technology to insurance(3), but in doing so has faced difficulties in the timely training and recruitment of people with expertise in both the insurance business and the latest analytics techniques. Hitachi, on the other hand, has been looking to supply its expertise in the analysis of medical big data to life insurance companies, recognizing that an understanding of their actual needs is essential to collaboration with insurance companies. It was against this background that Hitachi and Dai-ichi Life embarked on this joint research as partners with common aims and facing common challenges (see Figure 1).

Figure 1—Joint Research with Dai-ichi Life on Use of Medical Big Data The development of hospitalization risk prediction models and other such technology, and its deployment in the insurance industry, is being investigated by fusing expertise from both Dai-ichi Life and Hitachi.

The development of hospitalization risk prediction models and other such technology, and its deployment in the insurance industry, is being investigated by fusing expertise from both Dai-ichi Life and Hitachi.

Standard practice at life insurance companies is to base underwriting decisions about whether or not to accept insurance applications on factors such as the information provided by the applicant and the results of a health check (a process called “risk selection”). If an insurance company accepts large numbers of applicants with pre-existing conditions or with a high risk of dying in the near future, for example, the number of claims will significantly exceed expectations, undermining the viability of the insurance system. This makes it very important for insurance companies that they get risk selection right.

However, the requirements of the insurance industry include designing acceptance criteria that are more fine-grained than in the past so that more people can take out insurance, both to fulfill public expectations for private insurance and for reasons that include changes in demographics and other aspects of the business environment in which the companies operate. Accordingly, the joint research with Dai-ichi Life started by looking for ways in which it could contribute to making acceptance criteria more fine-grained.

The joint research involved the creation of a model that uses information on applicant health at the time of application to predict the length of future stays due to lifestyle disease. The model was developed by utilizing Hitachi’s analytics know-how and Dai-ichi Life’s expertise in insurance medicine and medical underwriting to analyze medical information from insurance applications (included information provided by the applicant and that obtained from checkups) and claim payment data built up by Dai-ichi Life over its many years in the health insurance business. While “insurance risk events” take a variety of forms (hospitalization, surgery, illness, and so on), acquiring the ability to predict risk in terms of the length of stay provides numerous insights into the optimization of acceptance criteria in the risk selection process. Accordingly, model development focused on hospitalization due to lifestyle disease as a way to study the criteria to use for such conditions.

Applicants seeking to take out life insurance typically have to disclose certain information about themselves, including considerable medical information. Moreover, because insurance policies have multi-year terms, it is possible to acquire information on any medical events that occur during this time after the policy is granted. Accordingly, Hitachi drew on its modelling expertise and past experience with the analysis of clinical and medical claims data to use this information as the basis for developing a model that predicts the length of future stays based on information on an applicant’s health at the time of application.

The information dealt with by the health check given to applicants can be broadly divided into general clinical information and disclosure information specific to private health insurance. The clinical information includes various numerical scores such as those obtained from blood tests, and the disclosure information includes large amounts of information such as the applicant’s medical history. The challenge for the prediction of future hospitalization is to identify which information in all of this is genuinely relevant to ill health. Accordingly, the different types of data were first converted into forms that facilitate analysis to create a dataset of characteristic data expressed in terms of both continuous (real-numbered) and binary variables. As lifestyle disease was the subject of the study, the next step was to identify the risk factors that contribute to hospitalization due to lifestyle disease and to develop a model. This was done by using machine learning to identify which factors within this large volume of data contribute to lifestyle disease, combining it with a statistical analysis to incorporate the clinical knowledge of physicians (see Figure 2).

When the resulting model was tested using trial data, it predicted length of stay with an accuracy of within 5%.

Figure 2—Prediction Model for Length of Stay The model covers eight different medical conditions: diabetes, cerebrovascular disease, kidney disease, cardiovascular disease, hypertension, malignant neoplasm, liver disease, and pancreatic disease.

The model covers eight different medical conditions: diabetes, cerebrovascular disease, kidney disease, cardiovascular disease, hypertension, malignant neoplasm, liver disease, and pancreatic disease.

A study was conducted into using the model for predicted length of stay as a way to loosen the underwriting acceptance criteria. The approach adopted by the joint research was to assess the suitability of current acceptance criteria by looking at the predicted length of stay for those people with some sort of abnormality in their health (such as the presence of conditions associated with high blood pressure, or abnormal laboratory results for liver function) in comparison to those in normal health (see Figure 3).

As an example, the graph in Figure 3 shows the predicted length of stay for a person with a pre-existing condition A and a person in normal health plotted against a particular laboratory result X [such as body mass index (BMI)]. The difference between the two indicates the expected value for length of stay.

Common practice at Dai-ichi Life has been to impose conditions on anyone with the pre-existing condition A for whom this particular laboratory result X exceeded a certain threshold, such as declining their insurance or raising the premium. However, the model indicates that the increase in hospitalization risk with higher values of the laboratory result X is not significantly greater for people with the pre-existing condition A than for those without. Accordingly, Dai-ichi Life revised certain of its previous criteria that took the form of “treat people with pre-existing condition A who exceed a particular threshold for laboratory result X as being high-risk” in those cases in which previous proposals for the loosening of criteria were backed up by the model result. As a result of these criteria revisions, Dai-ichi Life expects to be able to accept around 2,000 applications annually that would previously have been rejected.

Figure 3—Risk Comparison Based on Expected Value for Length of Stay The graph shows a risk comparison in terms of the expected values for length of stay for a healthy person and someone with a particular combination of pre-existing condition and abnormal laboratory result.

The graph shows a risk comparison in terms of the expected values for length of stay for a healthy person and someone with a particular combination of pre-existing condition and abnormal laboratory result.

This section describes the establishment and future plans for a risk simulation service for insurance companies that includes use of the hospitalization risk model.

Hitachi is planning to establish a risk simulation service that draws on the expertise in the application of hospitalization risk models to the insurance business that it has acquired through its involvement in the joint research with Dai-ichi Life.

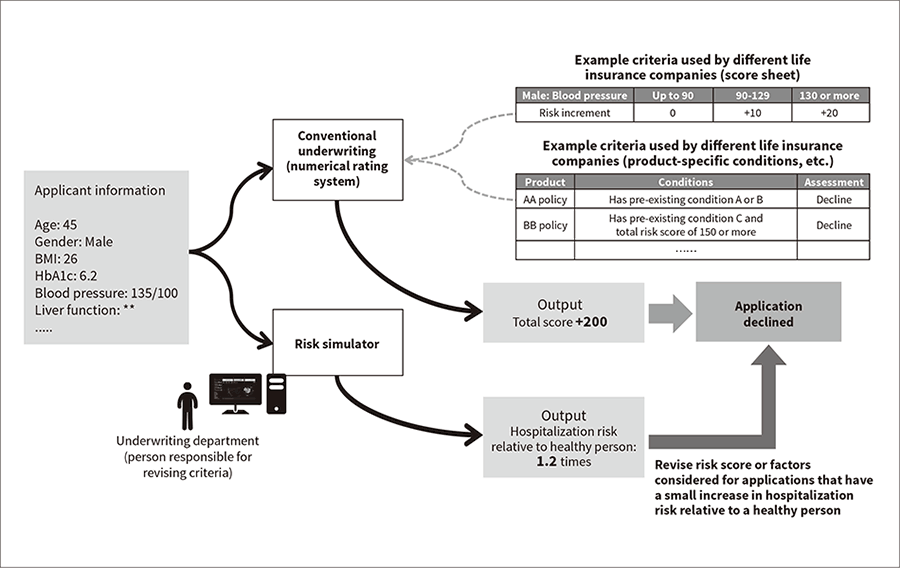

While this joint research used data held by that company, the challenge when developing general-purpose risk models is to obtain the input medical data. However, the increasing availability of medical big data in recent times, including health insurance data being made commercially available, means that it has become possible to build hospitalization risk models like that described above without utilizing life insurance data. Risk models based on this health insurance data can be used to predict the risk of future hospitalization based on information for individual policy holders (such as their being a male aged 45 with a BMI of 26). Whereas these numbers might have resulted in an application being declined under past underwriting criteria, the suitability of these criteria are called into doubt if the model predicts only a small increase in risk relative to a healthy person. While the extent to which underwriting criteria (risk score under numerical rating system) should actually be modified is a matter for the insurance companies using the service to decide for themselves, the service can at least indicate where past underwriting criteria over- or under-estimate risks in the risk selection process for individual applications (state of health) (see Figure 4).

Figure 4—Use Cases for Hospitalization Risk Simulation Service The suitability of underwriting criteria with respect to certain hypothetical insurance applications were studied by comparing the results under past practices with the risk analysis produced by the model.

The suitability of underwriting criteria with respect to certain hypothetical insurance applications were studied by comparing the results under past practices with the risk analysis produced by the model.

While this service is intended for use in underwriting by life insurance companies in Japan, it also has potential applicavtions outside the insurance industry. Given the increasing interest being shown by businesses in staff health management, examples of such applications include use of the service to assess the risk of employee non-attendance, or its use as a means of assessing employee health risks in the services provided by some banks that include the level of a company’s health management as a factor in setting finance interest rates.

Looking outside Japan, Hitachi would also like to utilize the service in the development of new insurance services through collaborations with some of the steady stream of new startup businesses not beholden to traditional risk underwriting methods that are emerging in the US insurance market especially, or in Southeast Asia where private life insurance is experiencing rapid growth.

This article has described insurance industry innovations that utilize expertise in the analysis of medical big data for insurance companies that Hitachi has built up over many years, together with examples of collaborative creation.

It is anticipated that the insurance and healthcare industries will, in the future, put even more effort into the development of new services that utilize not only medical big data but also data from the Internet of Things (IoT) and personal health records (PHRs). As part of this, Hitachi will continue working on the development of risk analysis technology.

Hitachi received considerable advice and assistance from The Dai-ichi Life Insurance Company, Limited and other parties involved in the work described in this article. The authors would like to take this opportunity to express their sincere gratitude.