COVER STORY:TRENDS

Jan-Philipp Hasenberg

Jan-Philipp Hasenberg

Senior Partner, Automotive Competence Center in Hamburg, Roland Berger GmbH

Studied at the University of Mannheim in Germany and Bocconi University in Milan. Since 2008, he has been advising leading automotive clients on sales and marketing strategies and the digitization of their value chains. His work focuses on innovative sales concepts, data-driven business models and sales structure optimization.

The automotive industry has undergone radical change in recent years. Connected, autonomous, shared & services, and electric, so-called CASE, trends have been globally embraced and even accelerated by pandemic. Compared to just a few years ago, sustainable transportation has been widely accepted, thanks to shifting consumer attitudes.

While COVID-19 introduced new levels of transportation uncertainty, mass quarantines did not slow the enthusiasm for zero carbon emissions, shared mobility, and transportation technology. But the pandemic did negatively impact the perception and reliance on public mass transit, at least in the short term.

What will “new normal” look like over the next decade? And more importantly, what can decision makers do to successfully navigate it? Based on our in-depth research and automotive experience, this is our answer.

Since Roland Berger first started researching CASE trends(1) five years ago, we have seen few, if any, signs of decreasing development. Although COVID-19 temporarily disrupted global supply and demand, the automotive market is still making sustainable technology a priority.

In fact, global interest in electric vehicles (EVs) has actually increased in recent years. More specifically, 55% of consumers are now considering the purchase of an EV, compared to 35% in 2017, according to our Automotive Disruption Radar (ADR) Survey(2) (see Figure 1). Similarly, venture capital investments in CASE have skyrocketed in recent years, peaking in both 2018 and 2020 at close to USD30 billion. While Tesla, Uber, and Lyft lead the way in both hype and research and development (R&D) spending, dozens of others around the world are gaining traction and investing notable amounts in sustainable mobility.

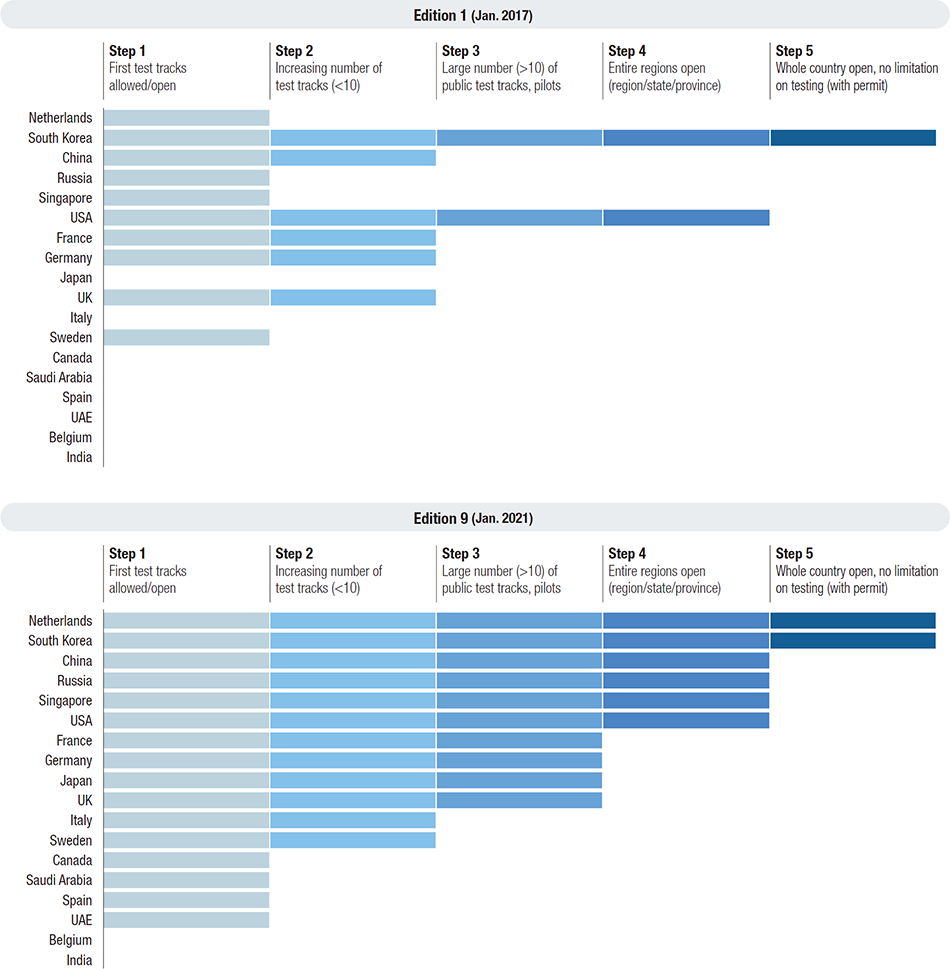

Additionally, new mobility formats have convinced more and more people to give up car ownership. Today, 65% of those we surveyed know at least one person who has given up their car, compared to 55% four years ago. On top of that, many countries are now testing autonomous vehicles on their roads. In 2017, just 10 countries were testing self-driving vehicles (see Figure 2). Japan is also active in testing especially in rural areas, according to our ADR research(3). And most countries are heavily investing in car charging stations and fifth-generation (5G) networks now, which are prerequisites for widespread adoption of autonomous vehicles.

Figure 2 | Autonomous Driving Test Tracks in Automotive Disruption Radar Countries

Obviously, COVID-19 has had a big impact. But not in a net negative way. In fact, COVID-19 has actually accelerated digitization, R&D, and changing tastes towards CASE innovations. For example, after lockdowns forced people to adopt remote, hybrid, or otherwise flexible working environments, the majority of office employers, over 75%(4), have permanently decided to keep hybrid office environments, which reduces the need for daily commutes. Even Porsche has announced plans to let non-factory employees work from home up to 40% of the time(5).

What is more, the pandemic caused a notable uptick in online car purchases, which is an encouraging opportunity for the industry. While car sales were negatively affected in 2020, buying intentions remain unchanged, especially for private cars. Before the crisis started, 69% of consumers said they considered access to a private car important. Today that number has risen to 76%.

Additionally, EVs have continued to grow. In our ADR analysis of 18 countries, we see that EV sales represent nearly 5% of total sales in 2020, compared to just 1.5% in 2017. On top of that, the unseen pandemic actually improved consensus and unified the world in the fight against climate change (see Figure 3). Decision makers in almost every industry made “sustainability” a top priority last year. Automotive managers are no different. But meeting our eventual carbon dioxide (CO2) emission reduction goals will require the full development of every CASE technology simultaneously, not to mention industry-wide support from top executives at leading automotive companies (see Figure 4).

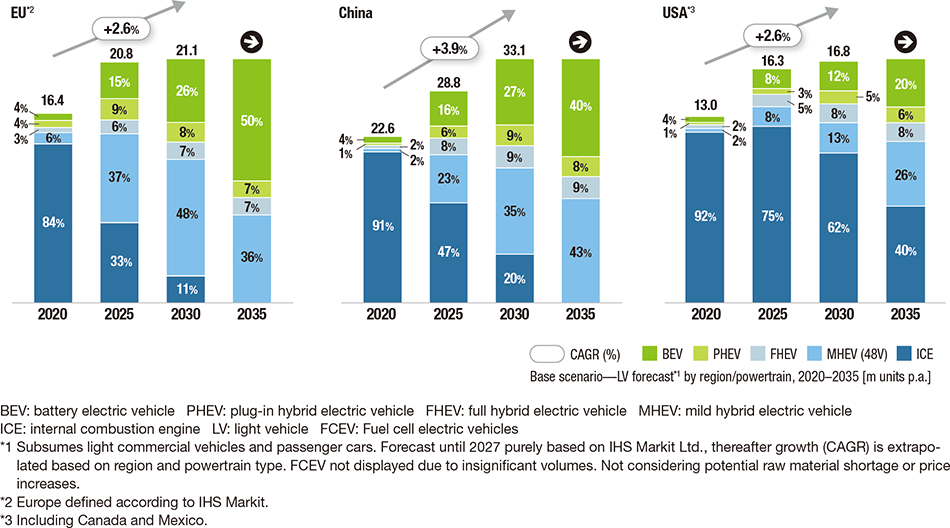

While 2020 undeniably changed the world, our forecast for their future of automobiles remains largely unchanged. This is because EV demand, supply, and regulations have stayed on the rise. By 2035, we expect EV production to reach 75% in Europe, 56% in China, and 32% in the USA (see Figure 5).

Figure 5 | Growth Rate Forecast for EV Market Regions Overall BEV market growth expected to grow fastest in China—ICE share is expected to decline significantly across regions.

Overall BEV market growth expected to grow fastest in China—ICE share is expected to decline significantly across regions.

While battery-powered vehicles will dominate, we believe hydrogen fuel-cell technology will remain a niche technology for passenger cars. But it will be a good fit for a wide range of industrial vehicles, according to our December 2020 study on heavy trucks. For example, in some of the case studies investigated, a similar or better total cost of ownership (TCO)*1 result for battery electric trucks was found. When conducting further stakeholder interviews, however, it became clear that the trucks used on the related routes should be able to allow for flexibility in operations in order to provide a long-term added value to the truck operators’ fleets. This flexibility (e.g., the necessary power of the fuel cell system, the tank volume, and payload considerations) can often be better ensured by fuel cells and hydrogen (FCH) trucks. Moving forward, we believe the debate about fuel cell technology will be enforced in the mid term. Through continuous improvement, we expect the technology to be a cost-effective consideration for commercial vehicles and even select passenger cars.

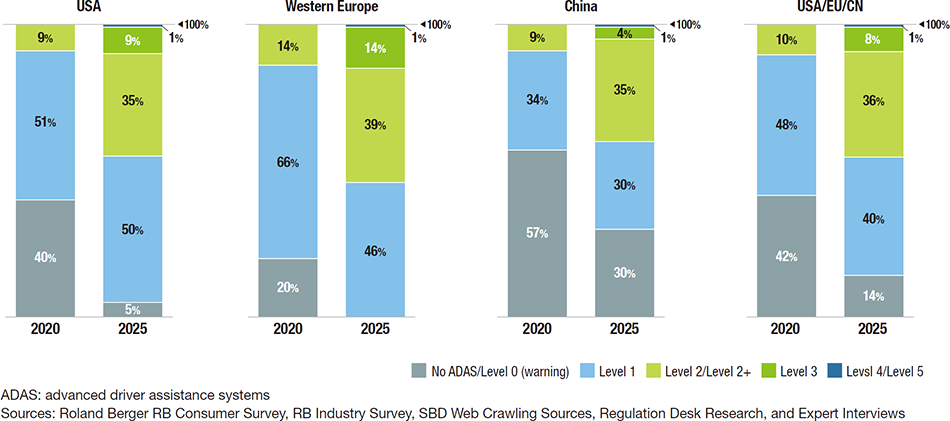

When it comes to autonomous vehicles, the future is also bright. As we showed in our most recent study of advanced driver-assistance systems (ADAS)(6), although 2020 temporarily slowed the development of more advanced driverless features, demand for driver-assist features at automated driving Level 2 and 2+ remains unchanged and they are expected to hit their forecasted penetration rates by 2025. Furthermore, investment and experimentation in fully autonomous vehicles also remain unchanged last year, so industry stakeholders remain highly motivated to bring the technology to market (see Figure 6).

Figure 6 | Forecast for Level of Automation in Regions

In short, ADAS will be a common feature of nearly every new vehicle sold in the developed world. According to our research, Roland Berger predicts the following:

To that end, cars will increasingly become “computers on wheels(7),” which has huge ramifications for manufacturers, automotive suppliers, and digital component suppliers. The car of tomorrow will deliver “mobility as a service” (MaaS), drive autonomously, operate in a fully digital environment, and be powered by an electric drivetrain. These macro trends are resulting in widespread dependence on and adoption of automotive electronics and software.

The consequences will be dramatic all along the automotive value chain. As such:

If the last half decade has taught us anything, it is this: sustainable mobility is here to stay. And like it did with many other aspects of society, the pandemic actually accelerated the drive towards sustainable transportation. As we increasingly move from automotive science-fiction to reality, many analysts predict challenging times ahead for both traditional players and novel startups seeking a piece of tomorrow’s automotive industry.

As valuations of Tesla [i.e., more than the top five original equipment manufacturers (OEMs)*2 combined] and other startups continue to soar, now is the time to assess your techno and strategic readiness to meet this future head on. After all, the chances of new players achieving high market valuations are very good. This is because markets assess their future potential rather than the state of today’s automotive market. Which is why even the most innovative traditional OEMs continue to experience relatively low valuations, making it harder for them to invest.

To better manage this challenge and compete with disruptive players, it may be necessary for automotive players to publicly highlight their proven strengths to market investors. Traditional manufacturers and suppliers should be proud of their successes and flaunt them. After all, the market still takes notice of such demonstrations of strength.

To help companies adjust to the new normal in the automotive industry—including post-COVID-19 strategies, disruptor threats, and maintaining a competitive advantage—we developed a “triple transformation” framework that considers market position, performance, and future forecasting(8).

First, we believe traditional automotive companies must re-assess their contributions, business models, partnerships, and investments based on realistic market developments. Next, performance should be the focus: we recommend strategic cost reductions and new value creation to help achieve pre-2020 sales levels as soon as possible. For instance, how can product and service portfolios be radically streamlined? And how can complexity be holistically assessed, managed, and reduced?

Lastly, we advise considering the long-term prospect. To that end, companies must renew their values to meet the changed expectations of customers, employees, and society as a whole. After all, today’s automotive industry has irrevocably changed and will continue to change over the coming decades. Those changes include but are not limited to the shift towards post-fossil fuels, growing demands for social justice, deglobalization, and economic volatility.

In short, we believe triple transformation offers a way through the challenges of this “new normal.”