Realizing real-time trades which take into account multiple financial products and complex trading rules

November 25, 2021

High-speed financial trading system using CMOS annealing

Hitachi, Ltd. has developed technology for applying CMOS annealing, which is suitable for solving combinatorial optimization problems*1, to high-speed financial trading. This technology has two main components:

The trading simulation demonstrates the usefulness of CMOS annealing for real-time processing: a portfolio can be computed within a practical time even while increasing the number of candidate stocks and trading rules to be considered. We will further develop this technology and collaborate with our clients to expand business applications requiring real-time combinatorial optimization processing, e.g., in manufacturing processes and traffic signal control.

Hitachi challenges itself to create services making our clients' business resilient to rapidly changing business situations. In many businesses such as financial trading and manufacturing process control, it is required to find an optimal combination of operations adapting to the real-time situation. A problem of finding such an optimal combination is referred to as a combinatorial optimization problem. Hitachi developed CMOS annealing*4,*5, as a technology to solve combinatorial optimization problems efficiently, and applied this technology to our clients' business issues*6,*7, such as optimizing a reinsurance portfolio for non-life insurance and optimizing the work-shift schedule of call center personnel. And this time, we have developed technology to support high-speed trading of financial products by CMOS annealing. This technology utilizes CMOS annealing to calculate an optimal portfolio for arbitrage trading*8 and supports the trading simulations evaluating the advantage of CMOS annealing.

When a financial product exhibits mean reversion, it is possible to perform arbitrage trading of buying low and selling high or short-selling high and buying-back low. A statistical method, cointegration test*9, is conventionally used to construct such a mean-reverting portfolio. In this method, however, it is difficult to flexibly take into account constraints due to market trading rules, e.g., the transaction fee and position for each candidate stock, and indicators such as liquidity risk. By using our technology, it becomes possible to construct an optimal portfolio in a short time even while increasing the number of candidate stocks, indicators, and constraints for the trading portfolio. Therefore, this technology realizes high-speed arbitrage trading based on a mean-reverting portfolio.

A part of these results was presented at the 22nd Conference of the International Federation of Operational Research Societies (IFORS 2021)*10 held on August 23–27, 2021.

We formulated the problem of finding an optimal mean-reverting portfolio as a combinatorial optimization problem by expressing objective functions and constraints to be considered in the arbitrage trade. We found that these objective functions and constraints could be expressed as a QUBO problem, which can be solved by CMOS annealing efficiently.

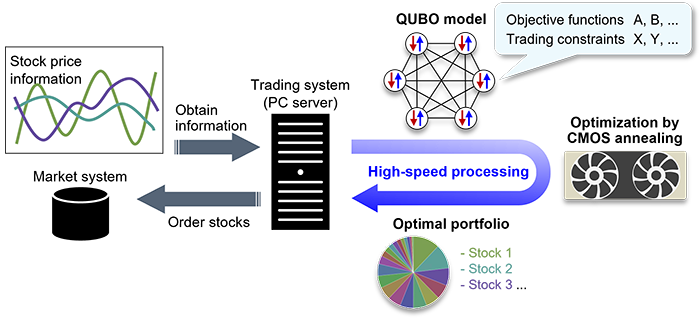

In this approach, CMOS annealing is able to calculate an optimal portfolio and present it to the trading system at high speed (Fig. 1). In real complex financial trading, it is required to consider many indicators and constraints which results in increasing the number of terms included in the QUBO formulation. However, the calculation time of CMOS annealing depends not on the number of terms but on the number of variables, which is determined by the number of stocks considered in the QUBO formulation. Therefore, our method can realize practical and fast arbitrage trading under many indicators and constraints.

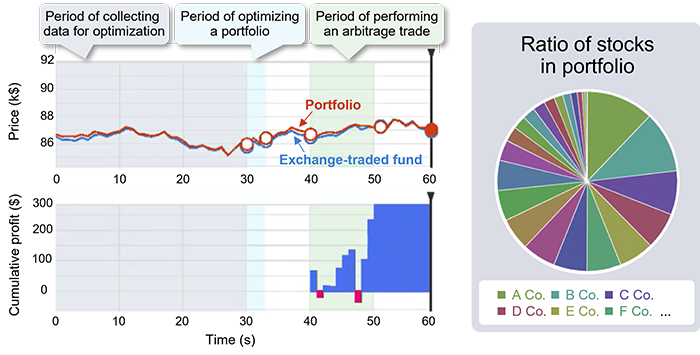

To check the impacts of indicators and constraints considered in the arbitrage trading strategy, it is required to perform a prior evaluation (backtest) of the strategy by numerical simulations using past market data. We developed a trading simulator with CMOS annealing, which makes it easy to carry out backtests while changing strategies or past data. Figure 2 shows a result of an arbitrage trading simulation using an exchange-traded fund and an optimal portfolio. Here, the price difference between the exchange-traded fund and the portfolio was optimized to be mean-reverting (top left in Fig. 2). The arbitrage profit was evaluated from the price difference (bottom left in Fig. 2). By performing backtests using approximately 100 stocks while changing the past data, it was confirmed that CMOS annealing constructed an optimal portfolio within a few seconds and the arbitrage trades by the portfolio indeed produced profits in the numerical simulations.

Illustration of the trading simulation in cooperation with CMOS annealing

Going forward, we will collaborate with our clients to carry out trials of this technology for various high-speed financial trades. Furthermore, we will also expand this technology to other business applications requiring an optimal combination of operations in real time, e.g., manufacturing process control and traffic signal control, and contribute to solve complex social issues.

For more information, use the enquiry form below to contact the Research & Development Group, Hitachi, Ltd. Please make sure to include the title of the article.