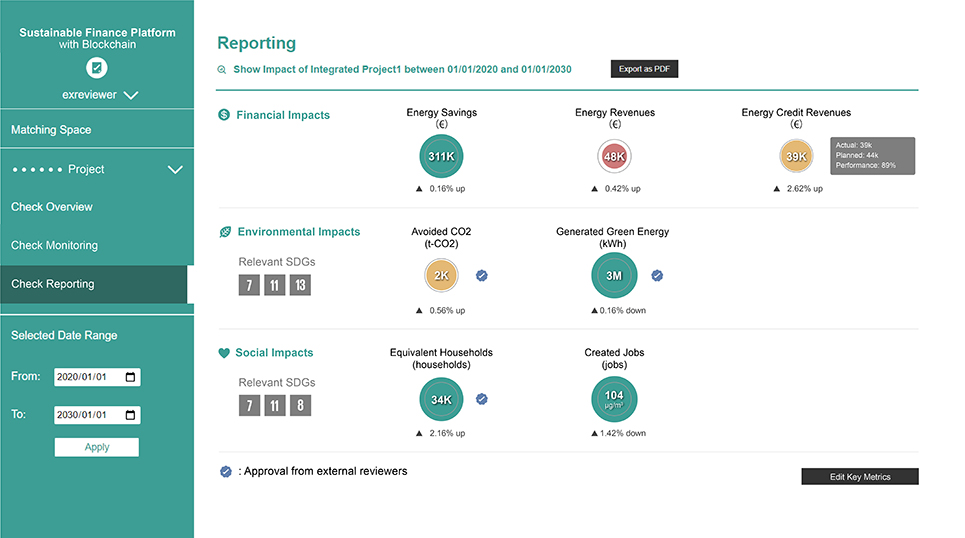

Three indicators in the digital platform: the projects’ economic, environmental, and social effects are visualized.

Text by Reiko Imamura

Sustainable finance and solutions to environmental issues such as greenhouse gas reduction are hot investments in the financial sector. The likely catalyst for the trend is the World Economic Forum’s emphasis since the latter half of the 2000s on the importance of investing with the environment (E), society (S), and corporate governance (G) in mind. Especially in the progressive EU, the market has grown significantly as has the amount of green bonds, or bonds allocated specifically for use related to the environment. These investments are projected to reach $350 billion in 2020, up 35 percent from the previous year (according to the UK’s Climate Bond Initiative), and major corporations have begun issuing green bonds and financing environmental projects. To say incorporating sustainable finance into one’s business plan is now in vogue is no overstatement.

Meanwhile, it might be said that the complicated, obscure process in store for green bond issuers and investors prevents the trend from wide spreading. The process in question—reporting. Issuers must submit impact reports annually, covering information like CO2 reduction and environmental improvements. This reporting process requires project monitoring, external evaluation, and other weighty responsibilities. Because reported effects are often only estimated rather than measured quantitatively, investors often have a hard time conducting comparative studies, and this lack of transparency in financial instruments is yet another factor hindering the spread of green bonds.

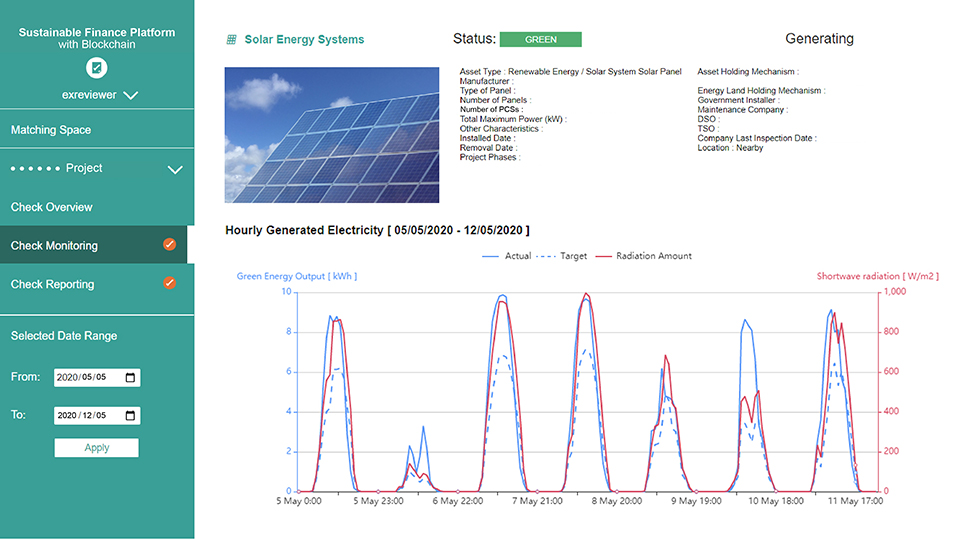

Monitoring the power generation status of renewable energy.

Thus, Hitachi set its eyes on the IoT and blockchain, presuming that yoking these two digital technologies with green bonds would reduce the burden placed on reporting parties and increase transparency.

For instance, a green bond issuer installs an IoT monitoring sensor on a renewable energy generator and records the raw data on the blockchain. The raw data is then converted into key performance indicators (KPIs), the quantitative effect is automatically calculated, and at this point, an initial impact report can be drafted. There’s no human intervention in the whole series of processes, so the data’s integrity and a high level of reliability are maintained.

The technology underwent verification in its prototype stage in 2019, with help from a photovoltaic generator in the UK. The front-end UI, intended for issuers, investors, and other stakeholders, was designed to manage multiple projects easily and automatically create impact reports. The focus was on visualizing three indicators: the projects’ economic, environmental, and social effects. The impact can be verified quantitatively, helping investors with their decision making.

In addition to the reporting function, Hitachi is also reviewing the possibility of a function on this platform that would match organizations in need of funding for environmental projects, with organizations looking to invest in highly transparent projects.

At Hitachi, our aim is to utilize the platform as a foothold in a co-creation process with issuers from the seminal stage of weighing different types of investment projects, and take the lead in designing and introducing systems that incorporate the IoT.