A Tech-Driven Evolution In Financial Transformation For Southeast Asia

What happens when technology is used to resolve business pain points in Southeast Asia? Enhanced efficiency, improved business outcomes and an overall better level of quality of life for everyone in the region.

Technology is the driving force of our society’s transformation. From streamlined communication to the automation of tasks, technology offers a myriad of benefits. Embracing innovative tools not only accelerates productivity, it also opens doors to new opportunities and possibilities.

Hitachi is a firm believer in technology and the role it plays in social innovation. By applying technology to finance problems in the region, Hitachi is confident of resolving long-standing issues and helping businesses generate greater value for their customers.

Deep Tier Finance: Helping Suppliers in the Supply Chain with Their Cash Flow Using Blockchain Technology

The supply chain is the backbone of global commerce. Within the supply chain sits a wealth of data that intricately intertwine, forming a multi-layered structure. Hitachi aims to connect the data in the supply chain, with an emphasis on improving cash flow for the suppliers.

Like all businesses, suppliers rely on financing to stay cash flow positive. Unlike buyers, suppliers need more assets to secure financing. With the help of Mizuho Bank, Hitachi is creating a new service called Deep Tier Finance. It generates tokens using the Hyperledger Fabric Blockchain technology.

The token serves as receivables for suppliers, enabling them access to financing earlier than usual. With this token, suppliers can secure financing based on the creditworthiness of their buyer. The token can be split down the supply chain to sub-suppliers to secure financing as well.

Deep Tier Finance can also help buyers by collecting ESG data in the entire supply chain. The ESG data may also be used by suppliers to access better interest rates.

Play this video to learn more about Deep Tier Finance

Elevating the Agricultural Supply Chain in Vietnam with the Agri-Platform

The agriculture sector plays a significant role in Vietnam, accounting for 14% of its GDP and more than 40% of the labour force. Despite its importance, it remains in a state of analogue agriculture, due to the absence of a system linking farmers and buyers together.

There are three nodes on the agricultural supply chain: buyers, cooperatives and farmers. Buyers cannot reach out to the farmers directly. They have to go through a cooperative to buy produce.

This makes it difficult for farmers to assess market demands and adjust to the needs of the buyers. Farmers also do not keep records of their produce and yields. They also do not have enough assets to act as collaterals to access financing from the banks.

To solve this, Hitachi is working with Sorimachi Vietnam to develop the Agri-Platform, a one-stop portal for sharing information in the agriculture sector.

Agri-Platform uses data in the supply chain to visualise farmers' agricultural activities to prospective buyers. It enables farmers to sell their crops to buyers directly by serving as a gateway for business discovery.

On top of that, financial institutions can also use the data in the Agri-Platform to evaluate risk factors when it comes to offering financing to farmers.

Play this video to learn more about the Agri-Platform

Using AI in End-to-End Solutions for Processing Loan Applications

Play this video to learn more about End-to-End Solution for Loan Applications

Gamification: Making the Insurance Journey Engaging and Fun

But what if buying insurance was as engaging as playing a game?

Introducing gamification: A concept that injects fun and engagement into the insurance buying process. Using this concept, Hitachi has developed an app to transform the insurance consideration process into an interactive adventure.

Players will encounter insurance concepts and learn through gameplay. Complex jargon can be broken down into digestible nuggets of information. The players are more likely to remember what they learn through gamified experiences, which improves customer engagement and satisfaction.

Play this video to learn more about Gamification

Deep Dive into ESG Data and Financial Indicators with the Help of AI

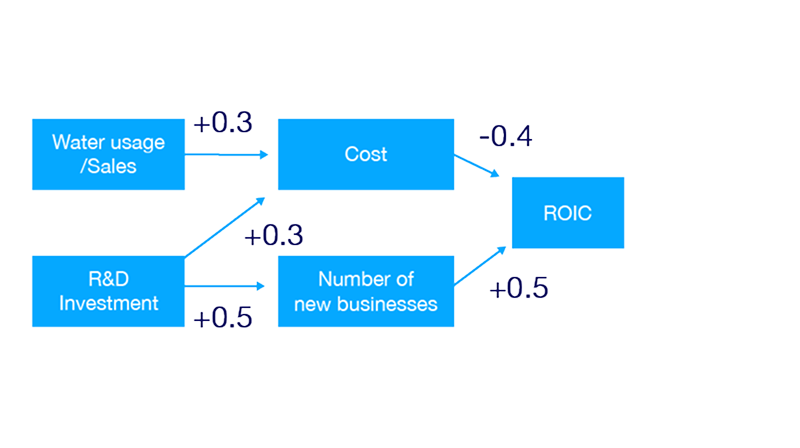

Technology #1: ESG Causality Modelling

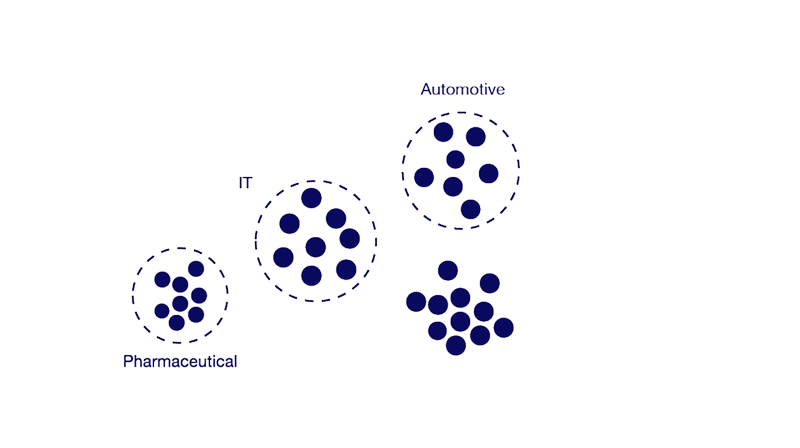

Technology #2: Clustering Analysis

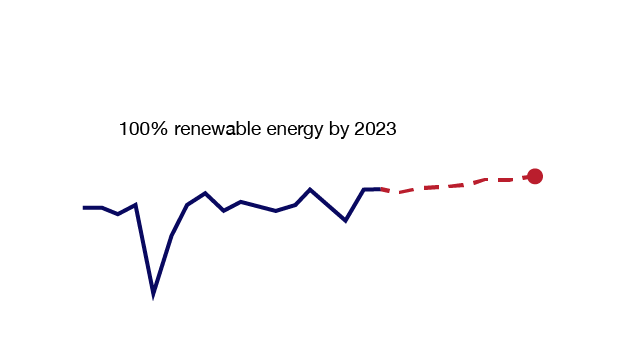

Technology #3: Policy Scenario Analysis

Play this video to learn more about Hitach’s technology for ESG reporting

Date of Release: April 2024