Dialogue with the Chief Lumada Business Officer

Nikkei Business Online Edition: September 2022 Special Feature

Faced with a changing business environment, more and more financial institutions are trying their hand in new business areas. In addition to conventional financial operations, they are pushing forward with new initiatives that go beyond existing frameworks. For example, some financial institutions are introducing FinTech and others are working on SDG- and/or ESG-related initiatives through finance. However, their path is not an easy one. That’s why Hitachi, Ltd. (hereinafter Hitachi) hopes to support their growth strategies through Digital Transformation (DX) and Green Transformation (GX). What kind of value can be created and what social issues can be resolved when financial institutions join forces with Hitachi? Yoshinari Hattori, Chief Lumada Business Officer of the Financial Institutions Business Unit, and Yoshimitsu Kaji, president of an AI-related startup company and Senior Principal of the Lumada Innovation Hub at Hitachi, sat down to discuss this topic.

―Recently, many financial institutions have been actively taking on challenges outside of their usual fields, for example, in areas related to DX, cross-industry collaborations, and initiatives related to SDGs and ESG. What is the reason behind this trend?

Hattori: It’s because of major changes in the environment surrounding financial institutions. Traditionally, Japan’s financial institutions have been protected by regulations and have enjoyed stable business. But, looking at it from another perspective, you could also say that they had been tied down by those same regulations, which is why any venture into new areas had been severely restricted.

The relaxation of these regulations gave rise to opportunities for business growth. At the same time, with FinTech companies and players in other industries breaking out of old frameworks and creating many new financial services, competition has intensified. Rapidly, more and more transactions are taking place online, rather than face to face. Whether a financial institution can meet these diversifying customer needs will determine whether it can survive and even grow.

To meet these various business challenges, financial institutions are changing at a fast pace: implementing DX internally, enhancing customer experience, and reforming their channel strategy.

Another key factor spurring financial institutions to transform is the expectation for them to resolve social issues, for example, working on SDG- and/or ESG-related initiatives or reinvigorating local economies. The involvement of finance in SDG- and ESG-related initiatives has become a trend around the world and financial institutions need to actively contribute in order to gain more support and trust from their various stakeholders, including the global market. Many financial institutions are pushing forward with a series of such efforts outside their usual operations.

Kaji: If we were to look at it from a more global perspective, another important factor is the fact that, in the Japanese market, severe population decline and persistent negative interest rates have made it harder for financial institutions to increase their revenue. Japanese megabanks realized that, in order to survive, they needed to break into the global market and so, about five years ago, they began shifting to other parts of Asia. Japanese banks that had previously invested in American financial institutions now set their sights on Asia, which was experiencing remarkable growth, and aggressively sought to partner with or acquire local banks in countries such as Vietnam, Thailand, the Philippines, and Indonesia. Major regional banks followed suit.

On the other hand, property and casualty insurance companies and life insurance companies, which are focused on FinTech, have been investing in and collaborating with startups around the world. There is a fast-growing trend of companies seeking sources of growth on a global scale, for example, by creating subsidiaries in Silicon Valley and then using those subsidiaries to acquire other companies. As such, expanding their business areas globally is another new challenge that financial institutions are now facing.

―Under such circumstances, what can Hitachi do to support financial institutions?

Hattori: Hitachi’s stance is to maintain a society that does not cross planetary boundaries*1 while also contributing to people’s wellbeing. Through its social innovation business, which seeks to create sustainable societies by using data and technology, Hitachi hopes to create a positive cycle leading to a better future for both society and individuals.

Taking that into account, we at the Financial Institutions BU*2 want to support the growth strategies of financial institutions from two axes: one being financial DX, which uses digital technologies and networks inside and outside Japan, and the other being financial GX, which aims to create sustainable societies.

With financial DX, we support the innovation of finance businesses by combining and quickly reconfiguring modularized businesses and services to meet each customer’s needs. With financial GX, on the other hand, our main measures include the disclosure of ESG information for the creation of sustainable societies and the construction of an inter-company data linkage platform.

Kaji: In June 2022, the Japanese government issued a cabinet decision in which it set forth its economic policy of “new capitalism.” DX and GX, which you mentioned just now, are also included in the grand design of this policy, which centers on investing heavily in four fields: people, science and technology, startups, and GX and DX. Actually, when former Chairperson of Hitachi, the late Hiroaki Nakanishi, served as Chairperson of Keidanren*3, he pushed forward with the concept of “Society 5.0 for SDGs,” and it is my belief that the government’s “new capitalism” policy strongly reflects Keidanren’s work to achieve sustainable capitalism.

Hattori: Hitachi has business groups not only in finance, but in a wide array of fields including industry and distribution, railway, healthcare, energy, and water and the environment. Leveraging the combined capabilities of those groups, Hitachi is promoting its social innovation business to transform society. As such, I think there will be many opportunities to unleash that potential in the field and in various business areas, for example, to gain a deeper understanding of a customer’s issues and concerns, to reach a mutual understanding in multistakeholder processes, or to build consensus.

The engine that powers the two types of transformation, DX and GX, is Lumada. Lumada refers collectively to solutions, services, and technologies that utilize Hitachi’s cutting-edge digital technologies. The Financial Institutions BU also considers it an important mission to make use of Lumada’s strengths. By taking advantage of Lumada, which combines digital technologies with the expertise and solutions that Hitachi has accumulated across all fields, we hope to support the growth strategies of our customers, namely, financial institutions.

Kaji: Nowadays, financial institutions must implement new, unprecedented initiatives with regards to both DX and GX. But since it’s a new endeavor, there is no existing knowledge base and no way to overcome the problematic hurdles that arise when collaborating with other industries. Lumada is not just a digital toolbox of systems and platforms. Rather, it lets you flexibly combine know-how cultivated in various business areas with solutions, design thinking, and other techniques and methods. And, crucially, this allows you to overcome those hurdles and discover and implement new value.

―What are some specific measures for financial DX?

Hattori: The solutions we provide are not just for financial institutions. By collaborating with other industries, we are expanding the scope to which our solutions can be applied. As one example, we have the smartphone app Shakai Sanka no Susume*4, which visualizes and encourages senior citizens’ social participation.

In Japan, which is a super-aging society, payouts for nursing insurance exceed 10 trillion yen per year and this has become a critical issue when it comes to building a prosperous and sustainable society. Results of research conducted by the JAGES project*5 over 20 years indicated that a higher level of social participation by a senior citizen correlated to a lower likelihood of being certified as requiring primary nursing care. This correlational data caught Hitachi’s eye and, in June 2022, we began providing an app that measures and visualizes instances when the user goes out or does other activities, and then offers health advice based on the data. First, we want each user to create opportunities for social participation while having fun, and then we hope to develop services that allow senior citizens to discover and choose types of social participation that suit themselves best. We are currently in talks with many companies and organizations regarding potential collaborations.

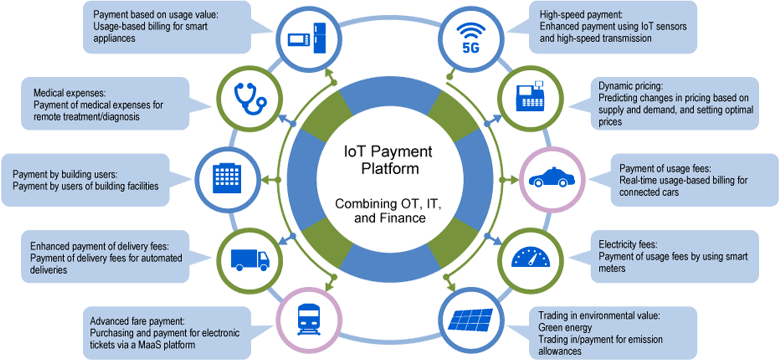

Another example is our IoT payment platform service*6, whereby we collaborate with customers on things such as the calculation of fees by using IoT data, payment methods, and the utilization of accumulated data. In 2019, we worked with the Railway Systems BU and conducted a PoC for an electronic ticketing service for Italy’s public transportation systems. The basis for that was the IoT payment platform. Simply by installing a special app on their smartphone, passengers could automatically pay transit fees without using paper tickets or IC cards, leading to a more seamless, comfortable transit experience.

Figure: IoT Payment Platform Service―Combining Financial DX with Other Industries

Based on the concept of combining IT, OT, and finance to create new value, the IoT payment platform service is a platform for collaborating with customers on things such as the calculation of fees by using IoT data, payment methods, and the utilization of accumulated data. By connecting the created billing model to monetization and payment systems, we can help promote the creation of new businesses.

Then, in March 2022, we began a PoC in Nagasaki City for a MaaS*7 platform for tourism, which combined Zenrin’s map database and IoT payment platform with Lumada solutions, such as an electronic ticketing solution that uses a rights distribution platform provided by the Social Infrastructure Systems BU. Encouraging regional development through tourism is an important measure for improving the sustainability of local economies. Going forward, we will work closely with different regions, using the results of the PoC to support regional revitalization.

Kaji: All of the projects you described are really interesting, particularly the PoC of the IoT payment platform being conducted in Italy. In this project, the Railway Systems BU first expanded into the European market, where they were later joined by the Financial Institutions BU. Together, the two groups brought electronic payment services to Italy’s railways and other public transportation systems. Then, the Social Infrastructure Systems BU joined in as well and the MaaS is now being implemented and even improved on in Japan as part of regional revitalization efforts. This kind of positive cycle where the optimal solution to one customer’s issues is flexibly reproduced on a larger scale is a unique benefit of using Lumada and allows us to create digital innovation across industries and national borders.

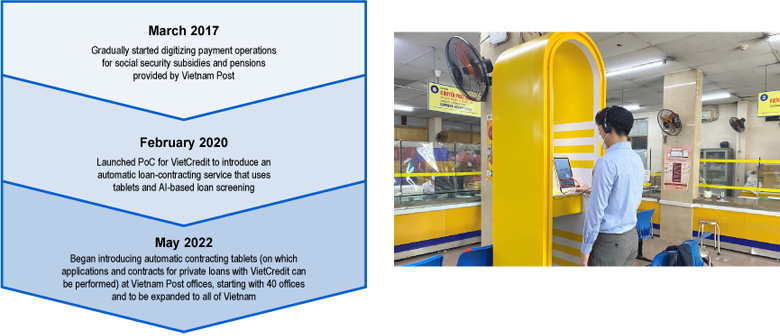

Hattori: The financial inclusion initiative in Vietnam is an example of a project we are working on outside of Japan. In Vietnam, economic growth brought about an increase in convenient services in urban areas. However, in rural areas, there was widespread disparity in terms of areas where services were available as well as the types of social services that were available. That’s why, in 2017, the Financial Institutions BU began a co-creation project with Sumitomo Mitsui Banking Corporation to digitize payment operations for social security subsidies and pensions provided by the state-run Vietnam Post.

Figure: Efforts for Financial Inclusion

There is growing global interest in financial inclusion, which refers to making financial services available to all, without leaving anyone behind. In Vietnam, where there is significant disparity from region to region, Hitachi is helping launch new financial services that use video calls between end users and operators. This gives people access to financing (loan applications, contracts, etc.) regardless of their location.

―Please also tell us a little about initiatives related to financial GX.

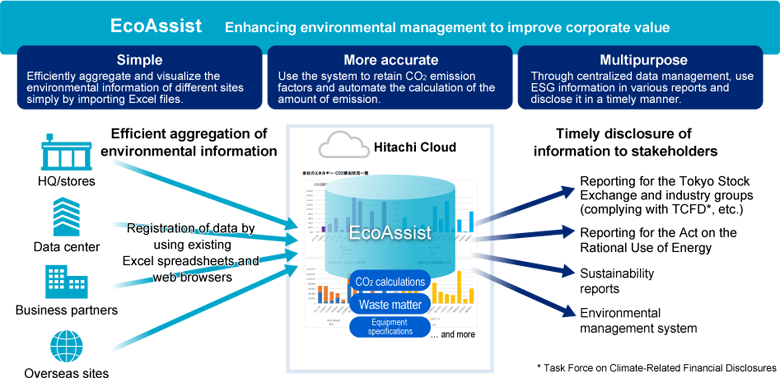

Hattori: As you know, taking steps to achieve carbon neutrality is a pressing issue for companies. In particular, this is closely connected to the Prime Market, which started after the Tokyo Stock Exchange’s market restructuring in April 2022. Companies listed in the Prime Market are required to disclose information as recommended by the TCFD*8. As such, those companies must disclose information not only about their own greenhouse gas emissions―which falls under Scope 1 or Scope 2―but also about the emissions of other companies involved in their business activities―which falls under Scope 3. In other words, in order to increase their own corporate value, financial institutions must keep tabs on the greenhouse gas emissions of customers to whom they grant loans. To that end, Hitachi’s Social Infrastructure Systems BU provides a solution called EcoAssist-Enterprise-Light, or simply EcoAssist, which visualizes each company’s environmental information as a whole and aggregates and analyzes that information from various angles.

Figure: EcoAssist-Enterprise-Light Solution for Financial GX

Hitachi’s environmental information solution EcoAssist-Enterprise-Light helps customers visualize, analyze, and improve their environmental management as a whole. By introducing this solution, companies can disclose to their stakeholders in a timely manner information about business risks related to climate change, as is required of companies listed in the Tokyo Stock Exchange’s Prime Market.

Besides providing EcoAssist to our customers―namely, financial institutions―we at the Financial Institutions BU also started a collaboration with the Mitsubishi UFJ Financial Group and Mitsubishi UFJ Trust & Banking in November 2021. This collaboration provides companies with support with the goal of creating a decarbonized society. We expect these types of efforts to expand to other financial institutions and their customers.

In June 2022, the Japan Exchange Group announced that it would be issuing digitally tracked green bonds, the first digitally tracked environment bonds in Japan. Here, too, Hitachi’s Sustainable Finance Platform is being used to record and manage various types of environmental data.

Going forward, we will continue developing platforms that, through the disclosure of ESG information, facilitate communication among financial institutions, stockholders, and institutional investors and help improve corporate value.

Kaji: Japan’s financial institutions are well aware of the benefits of working on SDG- and ESG-related initiatives. Playing an important role in those initiatives are platforms―like EcoAssist―for visualizing all information related to environmental management. To come up with an idea such as this, you’d need to have a multistakeholder perspective and Hitachi was able to bring this idea to reality precisely because of our breadth of knowledge related to value chains and our digital linkage system, Lumada.

―Going forward, how will the Financial Institutions BU help create social innovation?

Hattori: With the drastically changing environment surrounding financial institutions, financial DX and financial GX will only continue to accelerate. In the future, as financial institutions take on super-aging societies, regional revitalization, decarbonization, and other social issues related to digital and green transformation, I hope they will choose Hitachi as their co-creation partner. When it comes to innovating based on financial services, all the while keeping an eye toward the future, we will definitely bring something to the table. From here on out, I will continue promoting our business with confidence and conviction.

Kaji: Just the other day, we held a workshop at Lumada Innovation Hub Tokyo, where people from financial institutions gathered and thought about a vision and mission for DX. Japanese financial institutions are really trying hard to create innovation. That’s why they need an environment where experts from various fields can connect across company, industry, and even national boundaries to bounce ideas off each other, come up with new things, and then bring them to life. As the first company to provide such a space in both a real and a virtual sense, I think Hitachi is truly in a position to help resolve global issues. I will also do my utmost to promote such co-creation efforts.