Hitachi at a glance

Key numbers

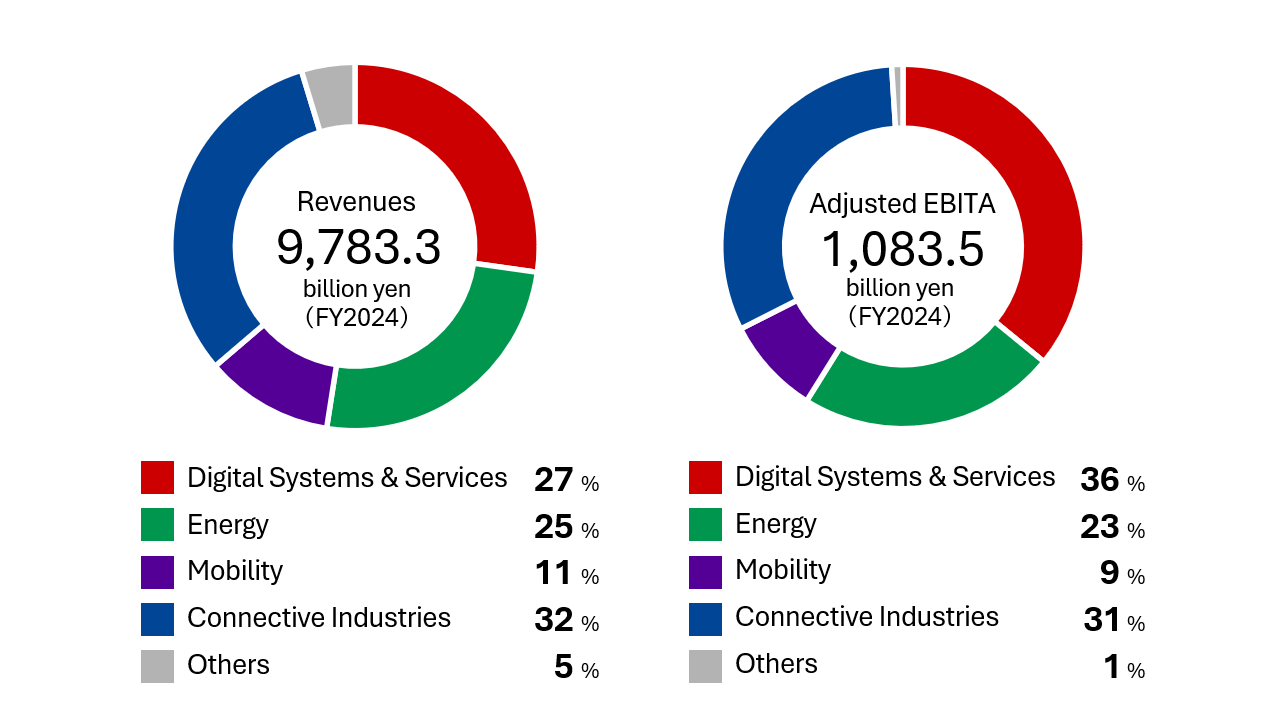

Revenues

for FY2024

Target CAGR of 7-9% (FY2024 - FY2027)

Adj. EBITA margin

for FY2024

FY2027 target of 13-15%

Cash flow conversion

for FY2024

FY2027 target of over 90%

ROIC

for FY2024

FY2027 target of 12-13%

Lumada business

revenues

for FY2024

FY2027 target of 50%

Lumada business

Adj. EBITA margin

for FY2024

FY2027 target of 18%

*Adjusted EBITA = Adjusted operating income – acquisition-related amortization

*Core FCF = Cash flows from operating activities – CAPEX

*ROIC = (NOPAT + Share of profits(losses) of investments accounted for using the equity method) / Invested Capital × 100

*NOPAT (Net Operating Profit after Tax) = Adjusted operating income × (1 – Effective income tax rate)

*Invested Capital = Interest-bearing debt + Total equity

*Cash flow conversion:Core FCF/Net income (excluding special factors)

Hitachi Group businesses

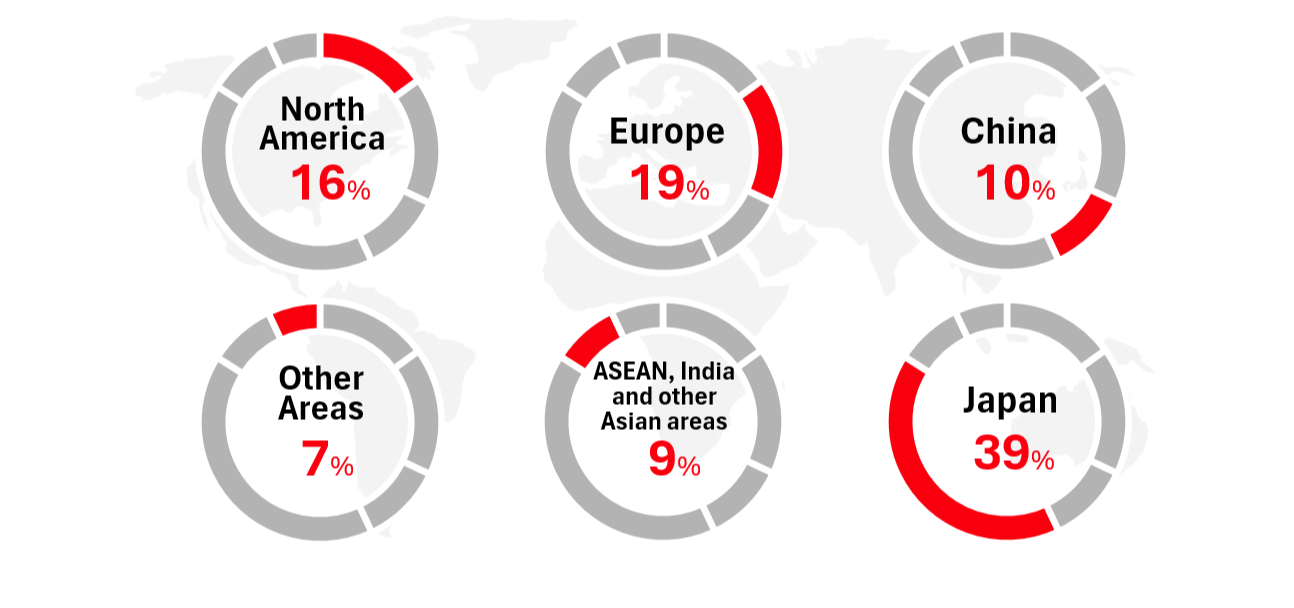

Revenues by Market (FY2024)

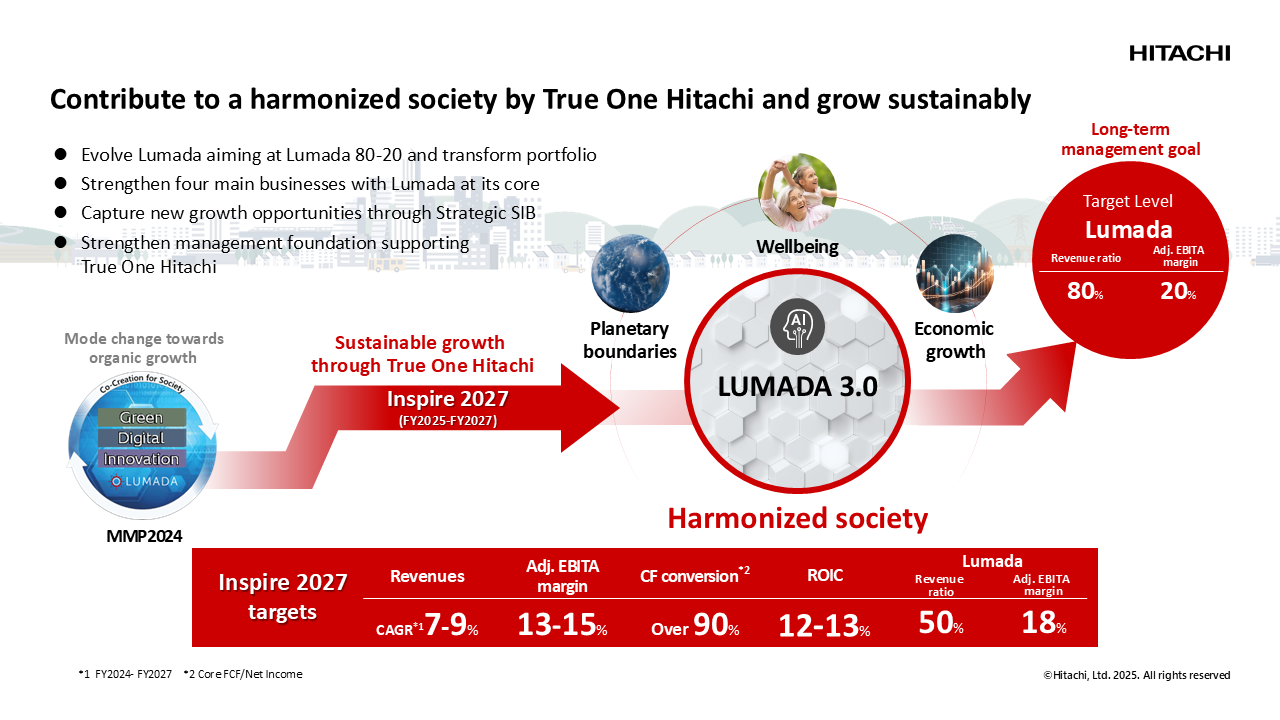

Inspire 2027, Hitachi Group's New Management Plan